Once again we find ourselves in a market of complacency. The VIX closed at 12.66 today which puts it in about the 13th percentile since 1990:

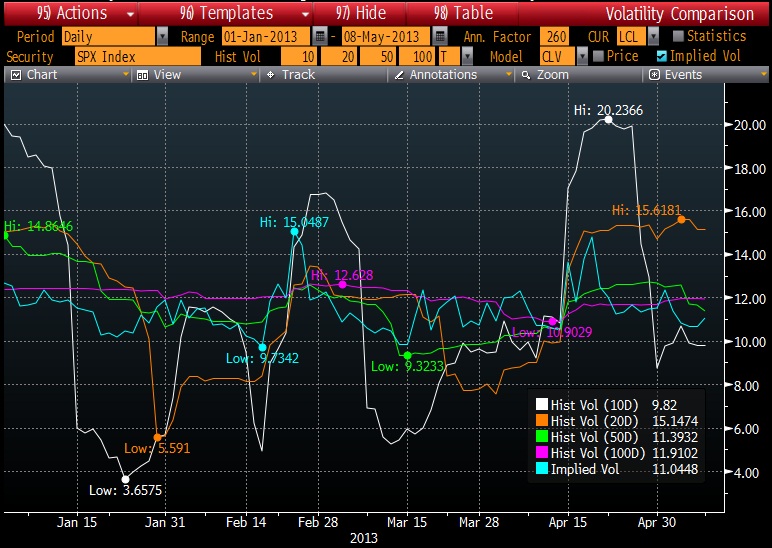

What is fun to notice in this all-time high flying market is that the 20 day trailing volatility is 15.6% while the 10 day is 9.8% and the 50-100 day are 11-12%. So basically the VIX is telling you that the little risk flare a few weeks back was nothing but a fluke:

So riddle me this – Is the 10 year treasury at 1.76% telling me

- that bonds are an inferior investment and we should all be plowing into equities

- that QE is an infinite cure to the common cold and interest rates no longer matter (so plow into equities)

- that a 1.76% yield combined with 1.5% inflation might just predict a rather sour economic environment

Thank you Ben and fellow global central bankers, you have succeeded in luring the sheep back into the chase for yield in one final and glorious conclusion.