Debt begets debt until it doesn’t. I have watched a noticeable change in the mood of many investment banks (yes, they are all technically commercial now), money managers, and large institutions as market values have rebounded and the edge of the cliff seems like a distance memory. The reflation has occurred with a vengeance and it seems that the calm has returned. The real question to ask is, “Now what?”

The underlying theme of this recovery is Keynesian, that the key to prosperity is through more spending. The world governments are creating more debt to ameliorate high unemployment levels and slow economic growth which were both caused by the high levels of debt preceding the financial meltdown. Does that make sense to you? The difficult question is not whether there will be a large disruptive correction in the currency markets or sovereign debt markets, but when? The United States and United Kingdom have been rolling short term government debt because they fear that if they were to extend out the debt to 10+ years, the debt markets would revolt, interest rates would rise rapidly and there would be large repercussions for the housing markets and respective currencies.

In Moody’s 2009 review and 2010 outlook the credit rating service agency said:

“For most of 2009, the assumption was that governments could decide on the timing: first react to the crisis, then announce future plans, and finally implement. Such an assumption may be proven wrong… Aaa countries will probably not have the luxury of waiting for the recovery to be secured before announcing credible fiscal consolidation plans.”

The summary is that some countries should proactively defend their currencies by raising interest rates even before their economies are on sound footing. The problem is that these countries most likely will not act to defend their currencies because of political pressures to manage unemployment and constituent dissent. It is my opinion that action will not be taken until after there is a fairly significant currency crisis that could ripple throughout the globe. The dollar might actually act as a safe haven, because it currently appears that other countries are in even more fiscally constricting boxes.

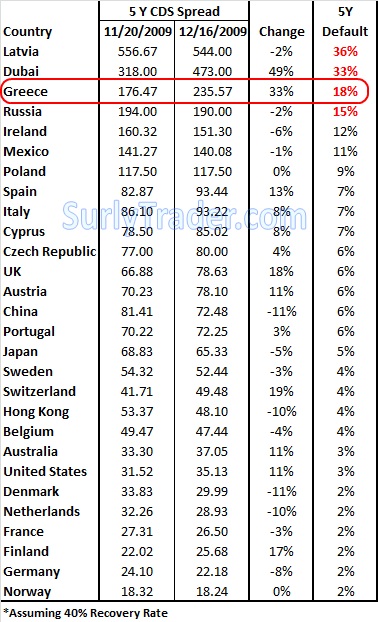

The default risk on Greece has risen over 30% since the default of Dubai and now appears to be the target for the next major disruption. This does not mean an unknown submarine default will not emerge elsewhere, just that the sharks are currently circling Greece for the next kill.

Currencies are a tricky bit of business because it is in each country’s best interest to look out for itself and not necessarily worry about the stability of the global markets. The United States has an incentive to depreciate its dollar to decrease its debt burden and increase the attractiveness of its exports, but other debt burdened countries have the same incentive. That is why the spiral can get out of hand rather rapidly in an arms race of loose monetary policy.

The key question is how to find some stability in the chaos. My suggestion is to look towards those countries with strong balance sheets and tie yourself to their currencies. How do you find those countries? Look at the bottom of the credit default swap list as far as default risk – Norway and Denmark, two countries not tied to the Euro with very strong balance sheets. I would not mind converting a few of my dollars to the Norwegian Krone for the coming debt binge induced inflationary aftermath.