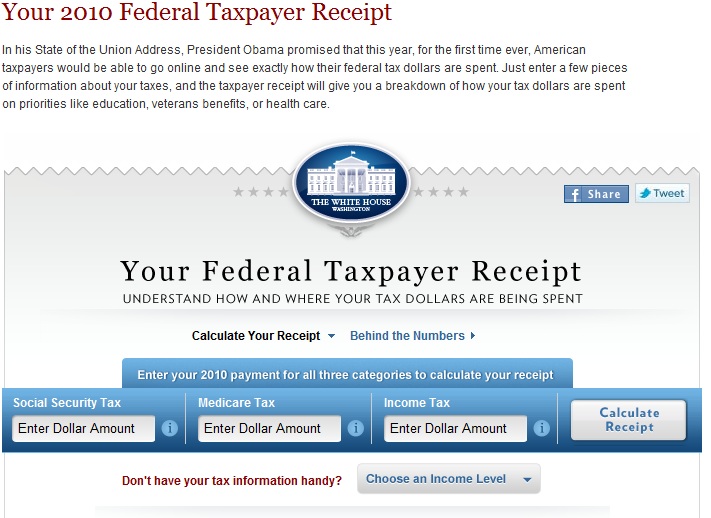

After you submit your taxes tonight maybe you should look to see where those Federal tax dollars are going. Enter your Social Security Tax, Medicare Tax and Income Tax – then weep:

Your Federal Taxpayer Receipt

Posted in Politics.

Comments Off on Your Federal Taxpayer Receipt

– April 18, 2011

Noteworthy News – April 18, 2011

Economy:

World Bank president: ‘One shock away from crisis’ – BBC

The economics of violence: Are countries poor because they are violent or violent because they are poor? – Economist

Inflation in China Poses Big Threat to Global Trade – New York Times

Markets:

World’s Poor ‘One Shock’ From Crisis as Food Prices Climb, Zoellick Says – Bloomberg

Food price hikes could push millions to poverty – CNN Money

Politics:

Congress will raise debt limit: Geithner – Reuters

Party Like It’s 1937 – Barron’s

Banks:

Euro vs. Invasion of the Zombie Banks – New York Times

Posted in Economics, Markets, Media, Politics.

Comments Off on Noteworthy News – April 18, 2011

– April 17, 2011

Edutainment Videos

Without humor a lot of what is going on would be depressing. If you enjoyed Quantitative Easing, you will definitely enjoy this entertaining and educational video:

If you want to protect yourself against inflation, don’t follow this baby’s path:

Does he sound a bit like Jack Black?

Posted in Conspiracy, Economics, Markets, Media, Politics.

Comments Off on Edutainment Videos

– April 15, 2011

The Mortgage REIT Explosion

You might have heard of Annaly Capital Management (NLY) which has been the darling of income starved investors. Annaly is one of the mortgage REIT’s, which is a fancy way of saying that they raise capital through an IPO, borrow enough money to leverage 5-7 times and then invest in mortgage backed securities. By leveraging 5-7 times, they are able to pay out very handsome dividend yields to their investors. In the case of Annaly Capital, they currently pay a 14.2% dividend yield.

The reason I bring them up today is that the business model is particularly perverse when the federal reserve is artificially keeping the front interest rates at or near 0%. Since Annaly capital is able to reverse-repo their agency mortgage back securities (secured loan from a bank) and borrow money at .25%, they are able to make a spread of 3-4% on the mortgage back securities that they buy. Borrow short, invest long, earn the spread. The business model is particularly simple, but a few are getting handsomely rich from it. What makes it particularly interesting is that Annaly invests exclusively in Agency backed mortgage securities, meaning that Ginnie Mae, Fannie Mae, and Freddie Mac guarantee the securities that they are buying. The agencies are backed by the government which is backed by the taxpayers. So in full circle, Annaly is borrowing short term from the Federal Reserve (through the Repo line) and investing in government backed securities. The taxpayers are lending to Annaly at a near 0% rate and the taxpayers promise to pay Annaly full Par value if any mortgages in the pools default. According to the recent filings, the heads of Annaly Capital are taking the Fed’s gift to the bank:

Who felt like they were being left out of the party? Well, PIMCO of course:

PIMCO REIT plans to raise $600 million in its IPO to invest in residential and commercial mortgage-backed securities and other residential and commercial real estate debt, according to SEC documents filed Tuesday.

When the new REIT completes its private placement, it will acquire a portfolio of agency residential mortgage-backed securities.

PIMCO is not the only asset manager getting into the mix, plenty of issuance to sate the investors’ yield hunger:

The bright note is that with $3.5B of issuance shown above levered at 5x, we could theoretically see $17.5B of demand for mortgage securities. Mortgage REIT’s could act as replacement buyers for the Fed.

The bright note is that with $3.5B of issuance shown above levered at 5x, we could theoretically see $17.5B of demand for mortgage securities. Mortgage REIT’s could act as replacement buyers for the Fed.

Posted in Markets.

– April 14, 2011