The term zombie banks seems to get a lot of attention, but zombie nations has yet to hit the mainstream. Let us try to change that. A zombie bank has an economic net worth less than zero but continues to operate because its ability to repay its debts is shored up by implicit or explicit government credit support. A zombie nation has a net worth less than zero but continues to operate because of its implicit support from other nations.

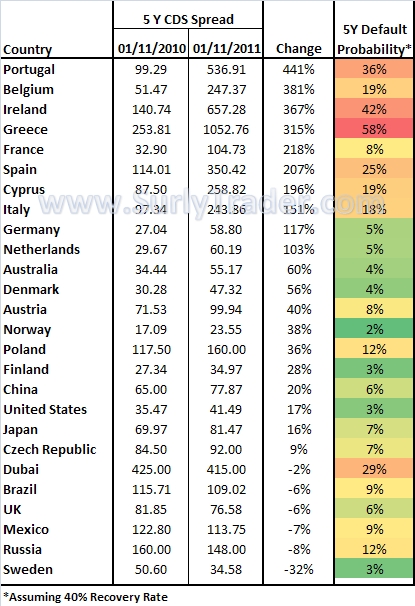

So what has happened over the last year? The credit spreads of corporations and zombie banks have collapsed while the spreads of nations have skyrocketed:

For all intensive purposes, Greece, Ireland and Portugal are insolvent and would be defaulting on their debts immediately if not for an implicit ECB guarantee. You can see that Italy, Spain, and Belgium are just on the brink. Who would have thought we would enter into a world where Mexico is viewed as half as risky of a borrower as Belgium?

2011 might be the year of large currency fluctuations. That could mean that option writing on currencies becomes the soup du jour.