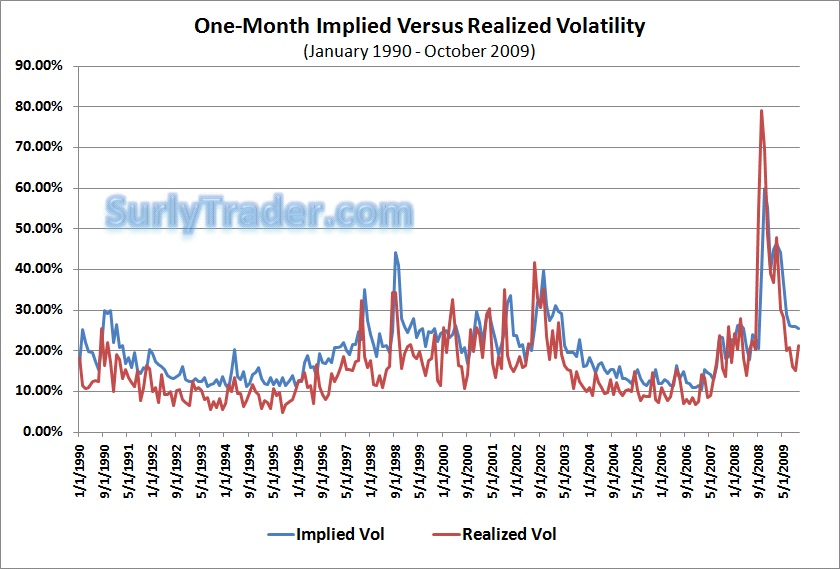

Volatility arbitrage generally refers to trading strategies that capture the spread between implied volatility (forecasted by option prices) and realized volatility (what volatility actually ends up being). The spread between these two volatilities can be captured by selling options (calls and puts) and delta-hedging the options by buying stock or futures contracts. This strategy effectively neutralizes the portfolio’s exposure to movement in the underlying stock while leaving the option seller exposed to the volatility of the underlying. If the volatility of the stock between the time that the option is sold and the time the option expires is higher than the implied volatility at the time that the option was sold, then the option seller loses.

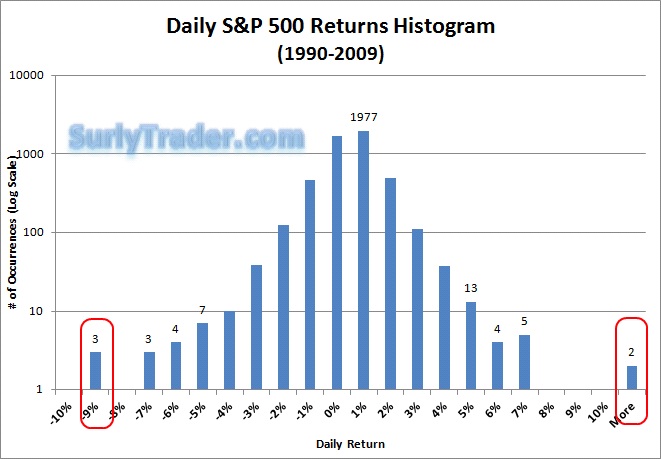

If you are scratching your head in utter confusion, do not worry. I will continue to delve into this topic with examples and pictures so that we can all grasp the basics. The general idea for the strategy is that options inherently trade at an implied volatility that is higher than realized volatility on average. Some academics (Nassim Taleb) believe that options trade at a higher implied volatility because Black-Scholes assumes a normal, bell shaped, distribution in stock returns. We can all agree that stock returns are anything but normal after going through the extreme volatility of 2008. In fact, during the 4th quarter of 2008 the S&P 500 had moves in excess of +/-5% during 25% of the trading days. If we assume that the S&P 500 has a long-term standard deviation of 20% on average, then a 5% daily move is in excess of 4 standard deviations. In a nutshell, equity markets are fat-tailed, meaning that observations that are far away from the mean happen much more frequently than a normal distribution can account for. Nassim Taleb would argue that these “Black Swan” events more than wipe out the small profits from selling options.

The truth is somewhere inbetween. It is true that massive dislocations in the markets can wipe out many months or even years of gains from selling implied volatility, but on average selling volatility has been a winning strategy even after taking into account large losses from 2008 or even 20%+ crashes much like the 1987 Black Monday. In fact, within his academic research study, Oleg Bondarenko found that it would take 1.3 October 1987 crashes every year for ATM put buyers to break even.

Nassim Taleb is right in suggesting that large outlier events occur in the markets more frequently than many people account for, but I think that he is wrong in asserting that put options are mispriced to the benefit of the option buyer. Two decades of data with the 1 in 20 year event (2008) included, show that being an option seller was much more lucrative than being an option buyer. The Standard & Poor’s Volatility Arbitrage index shows this fact even more clearly when looking at its historical results. The index replicates a variance swap in which the investor sells implied volatility and purchases realized volatility. Over the course of the 20 years, the index exhibited strong positive returns with very little standard deviation when ignoring the large draw down in 2008.

An interesting comparison is that between the S&P 500 total return index and the Volatility Arbitrage index. Most people believe that being long the equity markets is best way to put your money to work over the long haul, but I disagree. I would much rather sell option implied volatility rather than ride out the bucking bull and bear markets that are prolific in the S&P 500 stock returns. Yeah, you might have a draw down of over 30% from selling options like you would have during 2008, but the vast majority of the time you are collecting hefty premiums with little volatility. That sounds like a winning trade to me.

For those who are a little more fearful about selling options and delta hedging them outright, why not sell some call options on the stocks you do own as I previously suggested. That way you are selling option implied volatility and reducing the standard deviation of your equity positions.

This information also gives you a better framework when using options as a tactical bet. The next time you read an “investment” newsletter that tells you to buy options on such and such stock to take advantage of a huge potential move in the underlying, remind yourself that not only does that author need to get the timing and direction of the bet right, but he/she is fighting the law of averages by buying implied volatility.

Volatility selling on the S&P 500 can look even more attractive if you also hedge your dollar exposure into a strong foreign currency such as the Norwegian Kroner, Candian Dollar or Australian Dollar.

Be aware of your investments and if you get stuck in a rut, remember that researching total bankruptcy information can be the safest way to get back on your feet and can offer a second chance at rebuilding your finances. Always get the professional and trusting advice before you make your final investing decision

[Download not found]