- Treasury Yield Curve ETNs and Volatility

The subject of the VIX and Treasury yields is one I have probably not explored in sufficient detail in this space, so with some recent developments, this seems like a good time to dive into that subject.

One big reason for my interest is the recent rapid steepening of the Treasury yield curve. Another is an excellent article on two yield curve ETN plays from Timothy Strauts of Morningstar: How to Take Advantage of a Steep Yield Curve. In the article, Strauts discusses two ETNs from iPath that are designed to take advantage of a yield curve that becomes steeper or flatter. The ETNs are known formally as the iPath US Treasury Steepener ETN (STPP) and the iPath US Treasury Flattener ETN (FLAT). These innovative and exciting ETNs hold 2-year and 10-year Treasury futures and are rebalanced monthly. In many respects they represent the latest generation of what I refer to as strategy-in-a-box ETPs.

Launched in August, STPP and FLAT have started to attract some attention in the last few weeks, as Treasury yields have become more volatile.

There is not yet much of a track record, but I will be interested to see how the movements in STPP and FLAT interact with movements in the VIX. For an initial pass, I have chosen to look at STPP and FLAT in conjunction with SPY and VXZ. (Note that I chose VXZ here in order to sidestep the strong contango in the VIX futures term structure that exacerbated the price decline in VXX as of late.)

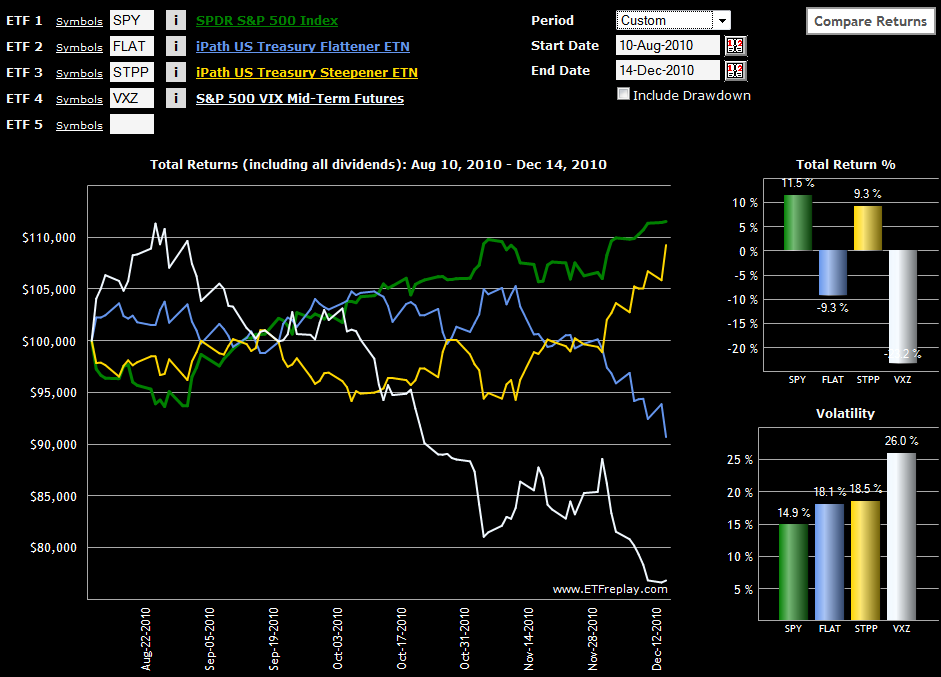

The chart below shows the performance of the yield curve ETNs since their August 10th launch. Note that so far – and particularly as of late – it has been FLAT which has been more positively correlated with changes in implied volatility expectations as measured by VXZ. On the flip side, STPP has demonstrated a higher positive correlation with stocks, at least as reflected in SPY.

Going forward, I will provide periodic updates on my observations between changes in the Treasury yield curve in the VIX and also take up the subject of how the Treasury yield curve might be able to predict the future of the VIX.

[source: ETFreplay.com]

Disclosure(s): short VXX at time of writing - Correlation And the Low VIX

ndex volatility, commonly proxied by the CBOE Volatility Index (VIX), has two main drivers. One is the volatility of the component stocks of the index. In the case of VIX, that’s S&P 500 (SPX) component stocks. The higher the volatility of the components, the higher the implied volatility of the index options. The other driver […]

- Chart of the Week: Banks on a Tear

There were many cross-currents in the financial markets during the last week, but one of the dominant themes was the spike in Treasury yields. As expectations for interest rates move higher, the banks are also catching a bid. Long able to borrow at Bernanke-induced artificially low rates, now banks are finding better prospects on the lending side – and have the added bonus of a larger yield spread on their loans as interest rates start to climb.

These factors make banks the focal point of this week’s chart of the week. In the graphic below, note that the upper study shows banks have been consistently underperforming the S&P 500 index for the past seven months. In the last week, however, banks have shown a dramatic turnaround that has lifted KBE, the popular bank ETF, above resistance (dotted blue line) and also reversed the trend of outperforming the broader market.

As was the case in 2010, the performance of the banks will be a critical factor in the performance of the broader market in 2011. Said another way, banks will continue to be a critical barometer not just of global growth, but of the ability of various economies to deal with threats to growth, such as sovereign debt and other issues.

[source: StockCharts.com]Disclosure(s): long KBE at time of writing

[source: StockCharts.com]Disclosure(s): long KBE at time of writing - Randy Moss And Yesterday’s Star Stocks

So I’m watching NFL Network on Thursday because……well, I always have NFL Network on. Nobody does game day, like Gameday! Plus this night had the added benefit of an NFL game on. Titans-Colts. With Matt Millen and Joe Theisman in the house! And I actually gleaned a market lesson. That the Titans prefer Third and […]

Today’s Option Blogs December 15, 2010

Posted in Markets.

Tagged with blogs, Derivatives, Options, skew, trading, Volatility.

Comments Off on Today’s Option Blogs December 15, 2010

By SurlyTrader – December 15, 2010