One of the top news stories today on Bloomberg was “US Existing-Home Sales Fall to Seven-Month Low on Rates, Supply“. This along with hawkish statements from the Fed seemed to come as a market shock, but in reality the mortgage and housing story has been building for many months. As we have all witnessed, interest rates have been on a tear alongside inflation since about the beginning of 2022. The Fed has been increasing the front end of the curve in an effort to dampen inflation, but longer-term rates have followed (or led) which has put a crimp on all borrowers. This has impacted the US Mortgage market more than others with the 30 year fixed rate mortgage moving from its mind numbingly low pre-2022 levels of ~3% to its current nosebleed levels of ~8%:

With this screaming rally in mortgage rates, one would think that it would have a negative impact on housing prices because debt becomes more expensive, but that has not been the case at all! In fact, house prices across America have gone up about 40% since 2022:

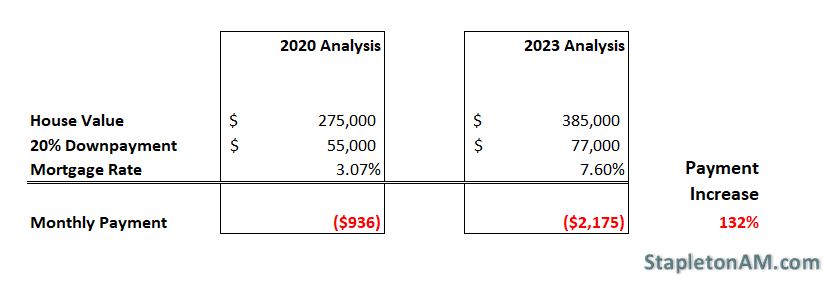

This leads us to the final question, how has this impacted the average buyer of a new house? If we take a rough example and assume a 2020 average house price of $275,000 (which is approximately true) and compare it to the new reality of a 40% increase in prices leaving that buyer with a $385,000 purchase for the same house, the math is painful. Not only was the buyer hurt by the higher purchase price, but also by a dramatically higher required downpayment and mortgage rate:

The buyer is faced with a $110,000 higher purchase price, a $22,000 higher downpayment, and a $1,239 or 132% higher monthly mortgage payment! It is a wonder that the housing market has held up as well as it has.