The US budget equation has not changed in the last few years…actually it has worsened. In early 2010 I pointed out that talks of discretionary cuts were a joke without cutting mandatory spending. Let us take a minute to put a slightly different spin on the problem.

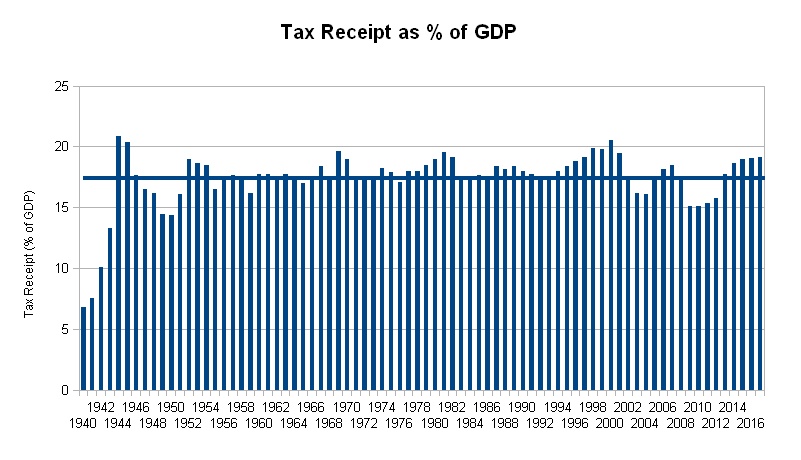

There is Republican talk of cutting taxes to increase GDP, job growth and thereby raise government receipts through growth and higher incomes. There is Democratic talk of raising taxes and cutting loopholes to raise receipts through higher rates. In all honesty, I think there is a maximum percentage of GDP that can be collected in taxes. Since 1940, the maximum amount that the government has collected in taxes has been a little shy of 21% of GDP:

The average over this time period has been 17.41% and you can see that despite different personal income and corporate tax levels, this yield has been incredibly static. I believe that regardless of corporate tax rates or individual income rates, there is a maximum that the government will end up collecting from its citizens and businesses. In 2012, this rate was projected to be 15.8% of GDP.

The average over this time period has been 17.41% and you can see that despite different personal income and corporate tax levels, this yield has been incredibly static. I believe that regardless of corporate tax rates or individual income rates, there is a maximum that the government will end up collecting from its citizens and businesses. In 2012, this rate was projected to be 15.8% of GDP.

Let us suggest that we are able to collect the maximum 20% of GDP and let us also be incredibly rosy and assume that US GDP will be $16.2 Trillion in 2013.

Total collected taxes: $3.24 Trillion

Total assumed MANDATORY outlays for 2013: $2.54 Trillion

Add another half trillion for interest payments (at incredibly low interest rates) and there is not much left for any discretionary spending. Talk about defense and education as much as you want, it just does not matter.