James Montier of GMO offered his perspective on the efficacy of “tail risk hedging” using tail risk protection. Tail risk can be defined as those “black swan” events that can rock an all equity portfolio and bring any long only investor to his/her knees. I agree with Mr. Montier that, after the 2008 crisis, tail risk hedging seems to be the sales pitch of the day:

“Keynes argued that the “central principle of investment is to go contrary to general opinion, on the grounds that, if everyone is agreed about its merits, the investment is inevitably too dear and therefore unattractive.” This powerful statement of the need for contrarianism is frequently ignored, with disturbing alacrity, by many investors. The latest example in the long line of such behavior may well be the general enthusiasm for so-called tail risk protection. The range of tail risk protection products seems to be exploding. Investment banks are offering “solutions” (investment bank speak for high-fee products) to investors and fund management companies are launching “black swan” funds. There can be little doubt that tail risk protection is certainly an investment topic du jour.”

I also agree that most of the time when an investment bank offers you a “structured solution” you should run the other way.

What I did not necessarily agree with was Mr. Montier’s simplistic look at tail risk hedging products.

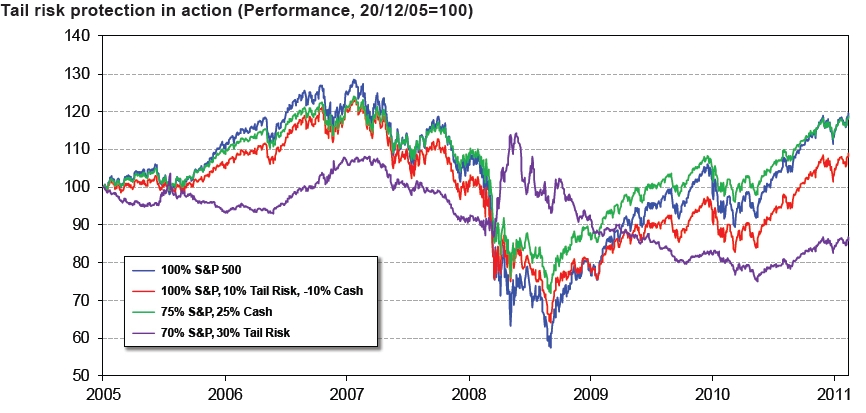

His examples included 4 strategies:

- 100% long S&P 500

- 100% long S&P 500, borrow 10% and invest in SPXSTR (AKA Ticker: VXX)

- 75% long S&P 500, put 25% in cash

- 70% long S&P 500, invest 30% in SPXSTR (VXX)

If you simply look at this chart, you would draw the conclusion that you prefer to sit in some cash rather than try to hedge the tail with VXX. I would like to point out two big issues that I have with that conclusion: 1) VXX has a terrible decay factor because of the upward sloping contango of the VIX futures curve (you can read about that fact for yourself) and 2) James Montier completely ignores the possibility that someone who hedges with VXX or some other volatility product might actually decide to take the hedge off when the VIX gets to 80%!

This chart would look completely different had James Montier also looked at midterm VIX futures (VXZ) as a hedge to tail risk. I get his point that cash is not bad as an allocation strategy and as a way to wait for the right risk premiums to show up in the market, I just think he could have made his point without throwing the idea of hedging equities out the door completely.

Read the full whitepaper here: [Download not found]

Value Investing: Tools and Techniques for Intelligent Investment

- ISBN13: 9780470683590

- Condition: New

- Notes: BRAND NEW FROM PUBLISHER! 100% Satisfaction Guarantee. Tracking provided on most orders. Buy with Confidence! Millions of books sold!

“As with his weekly column, James Montier’s Value Investing is a must read for all students of the financial markets. In short order, Montier shreds the ‘efficient market hypothesis’, elucidates the pertinence of behavioral finance, and explains the crucial difference between investment process and investment outcomes. Montier makes his arguments with clear insight and spirited good humor, and then backs them up with cold hard facts. Buy this book for yourself, and for anyone you know who cares about their capital!”

—Seth Klarman, President, The Baupost Group LLC

The seductive elegance of classical finance theory is powerful, yet value investing requires that we reject both the precepts of modern portfolio theory (MPT) and pretty much all of its tools and techniques.

In this important new book, the highly respected and controversial value investor and behavioural analyst, James Montier explains how value investing is the only tried and tested method of delivering sustainable long-term returns.

James shows you why everything you learnt at business school is wrong; how to think properly about valuation and risk; how to avoid the dangers of growth investing; how to be a contrarian; how to short stocks; how to avoid value traps; how to hedge ignorance using cheap insurance. Crucially he also gives real time examples of the principles outlined in the context of the 2008/09 financial crisis.

In this book James shares his tried and tested techniques and provides the latest and most cutting edge tools you will need to deploy the value approach successfully.

It provides you with the tools to start thinking in a different fashion about the way in which you invest, introducing the ways of over-riding the emotional distractions that will bedevil the pursuit of a value approach and ultimately think and act differently from the herd.