The implied volatility surface can truly hold a bit of investor sentiment that not many pay a lot of attention to. In the last few months, we have witnessed a collapse in the VIX which many view as an indication of investor optimism. For myself, it only implies that option traders are not expecting much to happen in the short-term, specifically within the next month. In fact, this predicted market lull holds out for a few months – with March at-the-money options trading at less than 17% and 3 month at about 18%. This compares to recent historical lows in the area of about 14%. With how the markets behaved in 2008, 2009, the summer of 2010, the summer of 2011 and with so many unknowns on the global economic horizon, I really believe 17% might be the new 14%.

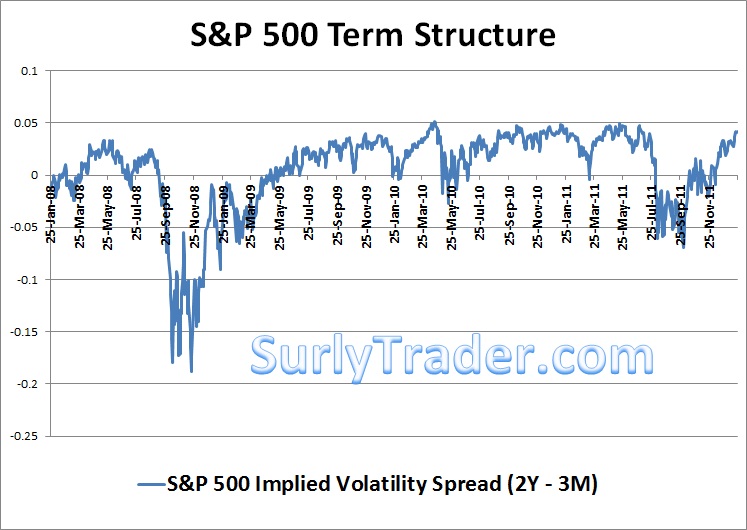

The interesting fact is how steep this term structure of implied volatility is. If we compare the 2 year implied volatility to the 3 month implied volatility, we can see that the implied volatility term structure spread is trading at its upper range:

What does this mean for you? It could be viewed as a signal for investor sentiment – that the near term might be calm while option traders are still expecting significant volatility in the future. It also means that short-term option hedges are a lot cheaper than longer term option hedges. This can be played by purchasing options in the near months and subsidizing these options by selling options in distant months.

In my own opinion, options purchased at a 16-17% implied volatility seem cheap when we look at the dislocations that seem to happen on a regular basis.