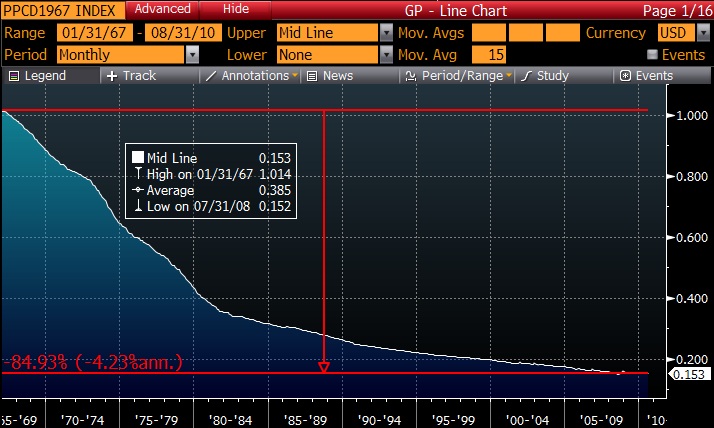

Nearly a year ago I talked about the continued devaluation of the dollar since going off the gold standard in 1971. The truth is that politicians around the world will continue to tax citizens through inflation unless they are forced to tie fiat currencies to some sort of hard commodity. One way to see this is to look at the purchasing power of the dollar in 1967 versus the purchasing power of the dollar in 2010. The fact is that if you had held a $1 bill in 1967 and you held it until today, you could now buy $.15 of goods. The dollar has lost 85% of its value and it has served as a 4% annual tax on the US citizen. If you earned $100,000 in 1967 and never got a raise you effectively earn $15,000 today, assuming you are still working.

Another way to look at real returns is to look at nominal prices versus commodity prices. We often hear investors talking about gold relative to nominal prices such as the S&P 500 or the Dow Industrials because gold has been considered the historical store of value. The problem with gold is that it is just one commodity. Gold by itself suffers from the fact that it will move dramatically in price based upon supply/demand imbalances whereas baskets of commodities are more stable. If we simply look at the Dow Jones versus gold, we would say that the Dow price index has gone down by 66% since 1967 or a loss of 2.5% per year in real terms:

If instead we look at the Dow Jones priced with the purchasing power of the dollar, then we would suggest that the real Dow Jones Price index has increased by 90% since 1967 or a fat 1.5% per year in real terms.

If instead we look at the Dow Jones priced with the purchasing power of the dollar, then we would suggest that the real Dow Jones Price index has increased by 90% since 1967 or a fat 1.5% per year in real terms.

The truth probably resides somewhere in the middle because the basket of goods used to determine purchasing power has probably changed in favor of the government and against the citizens. Dividends are not included in the above analysis so the real returns would be quite a bit better, but one takeaway should be that we are truly getting fleeced by the taxing power of inflation. Any media quoted “gains in the dollar” can be listened to with a cynical ear because we all know where the dollar and all other fiat currencies are headed in the long run.