With all of the volatility that has recently transpired, you wonder why you own any stocks at all. If you are an equity investor and about to throw in the towel, maybe it is time to redefine your strategy. It has been a while since I have talked about hedging equities with VIX futures, but I thought I would put some practical information back into play. The two most popular volatility exchange traded notes are VXX (short-term) and VXZ (mid-term). For the hedging of equity positions over long horizons, VXX tends to massively underperform as a portfolio hedge.

The nice thing about VXX and VXZ is that they have a long price history provided by Barclays on Bloomberg under SPVXSTR for VXX and SPVXMTR for VXZ that goes back to December 2005.

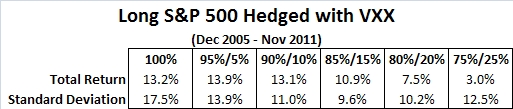

The basic idea in using these exchange traded notes is to maintain a primarily long equity position while allocating a portion of your funds to one of the ETN’s. We will use monthly data and assume that we rebalanced our positions to hold these allocations on a monthly basis.

In the case of VXX, we can see that adding a small allocation over this time period would have reduced the volatility of your portfolio. Unfortunately, holding a position in VXX lost money and reduced your return with larger allocations:

VXZ performed much better over the time period. In fact, over this particular piece of history you would have wanted to be long VXZ exclusively going into the global financial crisis.

Both of these strategies would be trumped by the dynamic VEQTOR allocation strategy, but that will be left for the interested readers to study.

As an alternative, what if we look at investing in dividend stocks while hedging with VIX futures? The S&P Aristocrats Index provides a nice venue for that analysis:

You probably would have had a much easier time sleeping through 2008.