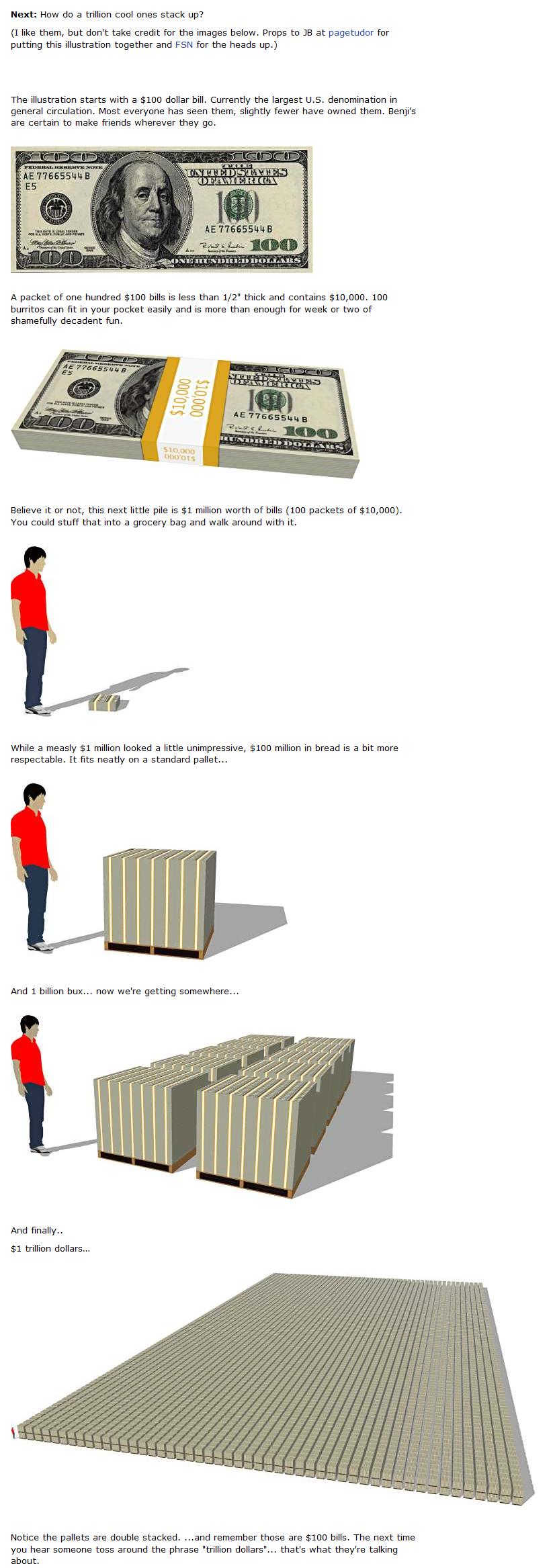

A useful infographic when current budget deficit talk revolves around fixing our current debt of $14.28 trillion dollars and unfunded liabilities of $113.8 trillion. If you really want to get depressed, study the real time debt clock.

How Much is $1 Trillion?

Posted in Markets, Media, Politics.

Comments Off on How Much is $1 Trillion?

– May 17, 2011

Matt Taibbi – People vs. Goldman Sachs

Matt Taibbi’s newest bash against Goldman Sachs is almost a week old, but I think it is important enough to comment on. The first point to make is that with all of the wall street analysts, buy-side equity research analysts, SEC, Office of the Comptroller of the Currency, the FDIC, Office of Thrift Supervision and even a specific Financial Crisis Inquiry Commission, we have to rely on Matt Taibbi of Rolling Stone magazine to come up with the most damning evidence against our largest financial institutions by analyzing Carl Levin and Tom Coburn’s WALL STREET AND THE FINANCIAL CRISIS: Anatomy of a Financial Collapse. I applaud the subcommittee for doing some legwork and I applaud Taibbi for bringing it to the American public. Likewise, I have seen the best articles about the financial crisis coming from Vanity Fair and the Atlantic. I am not sure what has happened to the media, but it certainly seems that all we get are spoon-fed AP releases.

Media rant aside, maybe Taibbi is able to come up with such pungent material because he actually works for the government. I would not find it surprising that a journalist has been picked by the FBI, CIA, SEC or some other government entity as the chosen media outlet. If that is the case, this latest article would make it seem that the government desires to make a post-financial crisis sacrifice of Goldman Sachs. The general public would not have too many sleepless nights from mass indictments of those in charge at Goldman.

A few choice nuggets from the article:

-

- Goldman, as the Levin report makes clear, remains an ascendant company precisely because it used its canny perception of an upcoming disaster (one which it helped create, incidentally) as an opportunity to enrich itself, not only at the expense of clients but ultimately, through the bailouts and the collateral damage of the wrecked economy, at the expense of society.

- Defenders of Goldman have been quick to insist that while the bank may have had a few ethical slips here and there, its only real offense was being too good at making money. We now know, unequivocally, that this is bullshit. Goldman isn’t a pudgy housewife who broke her diet with a few Nilla Wafers between meals — it’s an advanced-stage, 1,100-pound medical emergency who hasn’t left his apartment in six years, and is found by paramedics buried up to his eyes in cupcake wrappers and pizza boxes.

- Goldman was like a car dealership that realized it had a whole lot full of cars with faulty brakes. Instead of announcing a recall, it surged ahead with a two-fold plan to make a fortune: first, by dumping the dangerous products on other people, and second, by taking out life insurance against the fools who bought the deadly cars.

- To recap: Goldman, to get $1.2 billion in crap off its books, dumps a huge lot of deadly mortgages on its clients, lies about where that crap came from and claims it believes in the product even as it’s betting $2 billion against it. When its victims try to run out of the burning house, Goldman stands in the doorway, blasts them all with gasoline before they can escape, and then has the balls to send a bill overcharging its victims for the pleasure of getting fried.

- Goldman, as the Levin report makes clear, remains an ascendant company precisely because it used its canny perception of an upcoming disaster (one which it helped create, incidentally) as an opportunity to enrich itself, not only at the expense of clients but ultimately, through the bailouts and the collateral damage of the wrecked economy, at the expense of society.

Since this article, Goldman’s stock is down about 5% and their credit spread has gapped out about 15 bps to 134.8 bps. These are fairly modest moves, but if this stirs up a string of indictments it could end up being a long, hot summer for Goldman.

[Download not found]Chasing Goldman Sachs: How the Masters of the Universe Melted Wall Street Down.and Why They’ll Take Us to the Brink Again

Veteran Wall Street journalist Suzanne McGee explores why the Wall Street implosion happened and finds that the driving force was the belief among individual investors that they could make the kind of money taken in by the investment banking and securities firm Goldman Sachs.

Posted in Conspiracy, Markets, Media, Politics.

Comments Off on Matt Taibbi – People vs. Goldman Sachs

– May 16, 2011

Noteworthy News – May 16, 2011

Economy:

Is Your Religion Your Financial Destiny? – New York Times

New Yorkers under 30 plan to flee city, says new poll; cite high taxes, few jobs as reasons – NYDailyNews

Markets:

Cleveland Fed Estimates of Inflation Expectations

Rising Gas and Food Prices Push U.S. Inflation Higher – New York Times

A 1980 copy of Playboy Predicts the Future for Silver – Daily Reckoning

What If the U.S. Treasury Defaults? – Wall Street Journal

The new tech bubble: Irrational exuberance has returned to the internet world. Investors should beware – The Economist

Politics:

The Millionaire Retirees Next Door: Typical retired couples will collect $1 million or more in Social Security and Medicare. This is more than they paid in, and the cost will fall on today’s workers – Wall Street Journal

Tax property, not people, for a fairer society -Guardian

Geithner Predicts Double-Dip if Congress Fails to Lift Debt Ceiling – National Journal

Americans Oppose Raising Debt Ceiling, 47% to 19% – Gallup

Social Security and Medicare to run short sooner than expected – CNNMoney

Lifeguarding in OC is totally lucrative; some make over $200k – Orange Country Register

Banks:

Goldman Viewed Unfavorably by 54% as Poll Shows No Damage – Bloomberg

Posted in Economics, Markets, Media, Politics.

Comments Off on Noteworthy News – May 16, 2011

– May 15, 2011

Visualized Jobs Situation

It really looks like a nuclear fallout map. Kind of interesting to see the devastation that Hurricane Katrina caused in New Orleans as well.

Posted in Economics, Markets, Media.

Comments Off on Visualized Jobs Situation

– May 15, 2011

Mike Rowe Wants America to Change

Even if you do not watch dirty jobs, he has a great point.

Posted in Media.

Comments Off on Mike Rowe Wants America to Change

– May 12, 2011