Seasonality is well known by many investors. January is a strong month and November through May is when you should be invested in the market, A.K.A. “sell in may and stay away”. I am not going to spend much time proving or disproving market seasonality affects, but I thought it was worth digging into the month of September. It seems that I have consistently heard the pontificators say, “you know that September is always really ugly and given the crisis in Europe you should watch out!”

Looking at all trading months since January 1928, September does appear to be an ugly month on average:

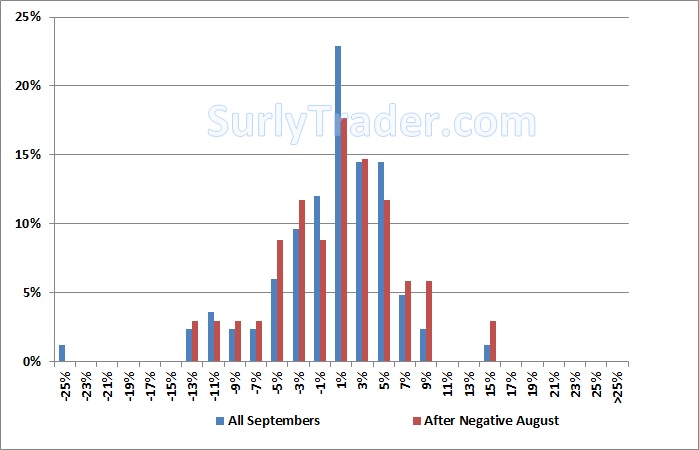

Let us look at the distribution of September returns along with the distribution of September returns that followed negative August returns:

It is hard to tell from the distribution, but the average return for the Septembers following negative Augusts was closer to zero at -.43%. In fact, if you just take out the -29.94% reading that occurred in 1931 you move from a -1.1% to a -.74%. If you remove the bottom 4 performing Septembers that all occurred between 1930 and 1937 then the average September return becomes a -.26%.

Even after trying to adjust for tails, it does appear that September has been a bad month. I guess the Europeans just do not like coming back to work after their long August vacations.