Guest Post from Chris Vermeulen at TheGoldandOilGuy.com

I think you will admit that we are in the middle of one major crazy financial mess. The part that makes things really crazy is that it’s not just in the United States anymore but rather serious global problem which if not handled properly could change the way we live our lives going forward or possibly even spark some type of war, hopefully things don’t get that crazy… But I do know one thing. Fear is the most powerful force on the planet and people do some crazy things when they are backed into a corner.

Anyways, on a more positive tone… today China decided to help provide more liquidity for the financial system along with the central banks. This news triggered a monster rally in overnight trading making the market gap up sharply at the opening bell. This news did hit the US dollar index hard sending it sharply lower but the question remains “Will today’s news be a one week hiccup in the market?” If Euroland starts printing money it will likely send the dollar higher and stocks lower for 6- 12 months.

Just today I was joking with Kerry Lutz of the Financial Survivor Network about how each country should just give each other country a second chance. Wipe the dept clean and start over knowing this time around exactly how each country truly operates at a financial level allowing everyone to avoid a repeat of this BS. Some countries will get off way better than others because they would get so much dept wiped clean but isn’t it better than years of problems and possibly wars over food, gold, guns, oil and Canadian water? – EH

All joking aside, let’s take a look at the weekly long term charts…

Dollar Index Showing Possible Massive Rally If Euro Starts Printing Money:

I’m sure my off the cuff options/thoughts will cause a stir but I am fine with that. Everyone I talk to is thinking the dollar is about to fall off a cliff while I think it’s very possible that it does just the opposite. Either way I will be looking to benefit from which ever move unfolds.

Weekly Gold Chart:

Weekly Silver Chart:

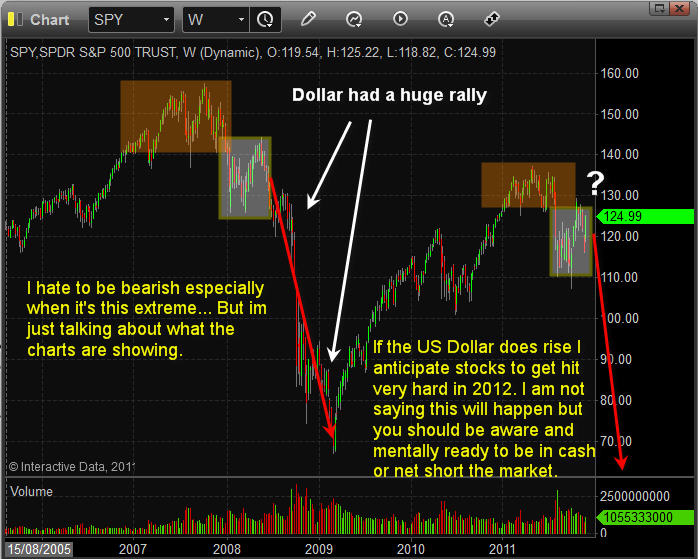

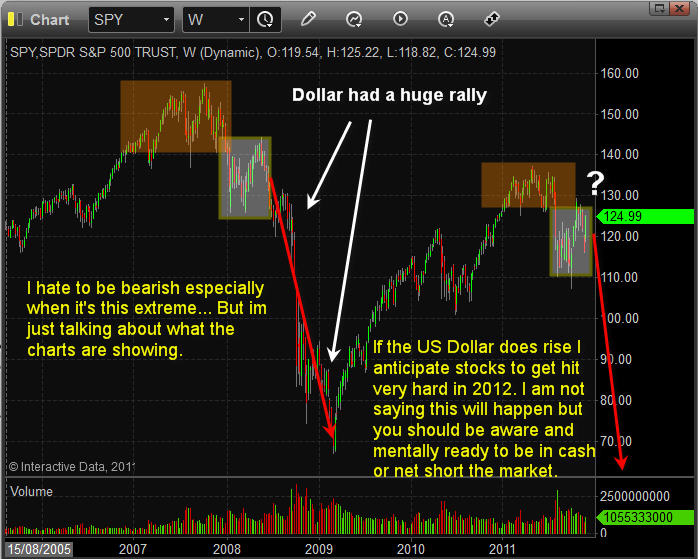

Weekly SP500 Chart:

Long Term Thoughts:

I would first like to say that tonight’s report is out of my norm. Generally I do not focus on the big picture negative stuff and I like to avoid it for a few reasons… One, it’s just downright depressing to talk and think about. And Second I don’t want to be labelled as one of those “The Sky Is Falling” kinds of guys.

So, that being said I think these charts above show a situation what is very possible to happen in the coming 6-12 months. Keep in mind that my focus is on short term time frames as it allows me to avoid and actually profit from major market moves while providing enough information for my followers to learn technical analysis and trade management. And the obvious idea of not looking too far into the future with a negative outlook…

With headline risk changing the market direction on a weekly basis, this negative outlook could easily change in a couple months. I will recap on the big picture as things unfold in January/February.