Japan is frantically trying to stop its deflationary trap and its immense debt burden. The population is aging and prospects look dire. On Halloween (great timing) the Bank of Japan threw the kitchen sink at the problem by announcing that they would increase their QE from ¥60-70 trillion, to ¥80 trillion ($700 B) and would increase its purchases of ETF and REIT’s. In addition, Japan’s $US1.2 trillion Government Pension Investment Fund will dramatically rebalance its portfolio away from bonds. These actions have depreciated the Yen versus the dollar by about 5% since the announcement and have created about an 8% jump in the Nikkei. If you extend the time period to the summer, the Yen is down about 13% while the Nikkei is up about 10%.

If you are a Japanese citizen, you have lost a significant amount of purchasing power unless you own a bunch of stocks (which they don’t). Going back to 2012, the loss is over 30%:

Let us be clear about Central Bank objectives:

- Ease out of or stop recessions from happening

- Keep employment strong by successfully implementing 1)

- Keep deflation at bay

- If you are in substantial debt, ease your way out of it through inflation

Number 4 is the item that we will focus on.

Japan’s debt to GDP is well over 200% (¥1 quadrillion!) and rising quickly. They have had a hard time getting their inflation to move upward and they have also added some taxes to try to bring their deficit down which has probably counteracted their inflation and growth targets. Inflation is the only plausible solution and depreciation of the Yen is key to Japan’s predicament. The recent aggressiveness of the Bank of Japan smells more of desperation than solution.

The one thing that I can cite as factual is that the Bank of Japan often purchases equities and other assets (not just government bonds) and is not bashful about it. My summary of their actions is that *anything is game*. Since the Bank of Japan is purchasing all of their own debt and a good chunk of those in existance are owned by Japanese families or Japanese entities, they have not seen the bond vigilantes who usually make governments become honest about their problems.

Without rising interest rates, Japan just needs to keep investors psychologically calm so that there is not a hyper-inflationary or crashing currency situation. One of the ways to keep investors calm is to stop gold and silver from skyrocketing in price due to a lack of faith in the currency and a scramble to preserve wealth through hard assets. It just so happens that the ex-Assistant Treasurer to the Reagan administration and co-drafter of the Economic Recovery Tax Act of 1981, Paul Craig Roberts hit the idea of central banks’ interaction with the gold market right on the head:

As we have demonstrated in previous articles, the bullion banks (primarily JP Morgan, HSBC, ScotiaMocatta, Barclays, UBS, and Deutsche Bank), most likely acting as agents for the Federal Reserve, have been systematically forcing down the price of gold since September 2011. Suppression of the gold price protects the US dollar against the extraordinary explosion in the growth of dollars and dollar-denominated debt.

It is possible to suppress the price of gold despite rising demand, because the price is not determined in the physical market in which gold is actually purchased and carried away. Instead, the price of gold is determined in a speculative futures market in which bets are placed on the direction of the gold price. Practically all of the bets made in the futures market are settled in cash, not in gold. Cash settlement of the contracts serves to remove price determination from the physical market.

Cash settlement makes it possible for enormous amounts of uncovered or “naked” futures contracts — paper gold — to be printed and dumped all at once for sale in the futures market at times when trading is thin. By increasing the supply of paper gold, the enormous sales drive down the futures price, and it is the futures price that determines the price at which physical quantities of bullion can be purchased.

You can read the full article here.

What I liked even more was the fact that over the last five years, when Asian physical delivery markets are open the returns are positive whereas they are negative when the London/US markets are open:

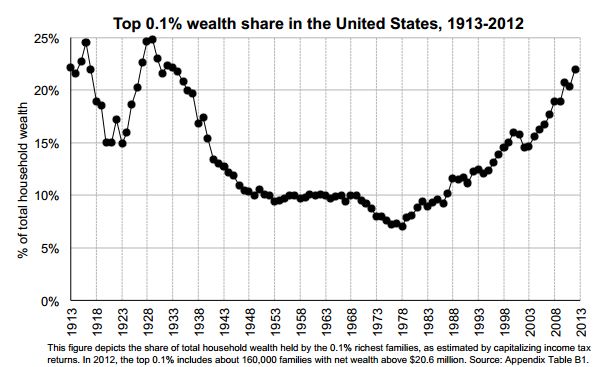

Lastly – Japan was successful in depreciating its currency starting in 2012. At the start of that slaughtering, Gold started to rally in Yen rather dramatically. By early 2013 that trend started to reverse and since mid 2013, Gold in Yen has been relatively flat even though the Yen is continuously crucified. Is it possible that the Bank of Japan wants to keep Gold unexciting as a preservation of wealth and move their citizens into stocks and “more productive” assets?

Just a coincidence or does the Bank of Japan not want their citizens to think they can preserve wealth with Gold?

Most interesting question is how can record demand for physical silver occur at the same time that the price is falling like a rock? – U.S. Mint temporarily sold out of Silver Eagles amid huge demand