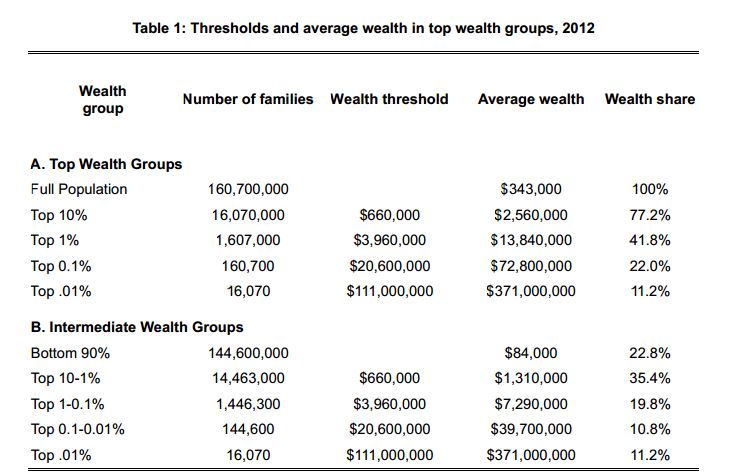

The Washington Post published an article with a similar headline with the focus on the bottom 90%. It is true and a dismal finding, but the more enlightening data is found in the very upper echelon of wealth. There has been a political and media focus on “the top 1%” but the reality is that the top 1% is a very different group that the top .1% or .01%.

The majority of the top 10% is not an extremely wealthy group. The 14.46M 10-1% group have an average household wealth of $1.3M which captures 35% of the total wealth or a little less than 4 times their equivalent share (if we gave every individual an equal piece of the pie).

More astounding is the top .1-.01% group of individuals (144,600 people) with an average wealth of $39.7M or 10.8% of the country’s wealth. This implies that this group possesses 120 times their equivalent share.

The very top .01% with average wealth of $371M own 11.2% of the country’s wealth and 1,120 times their equivalent share!

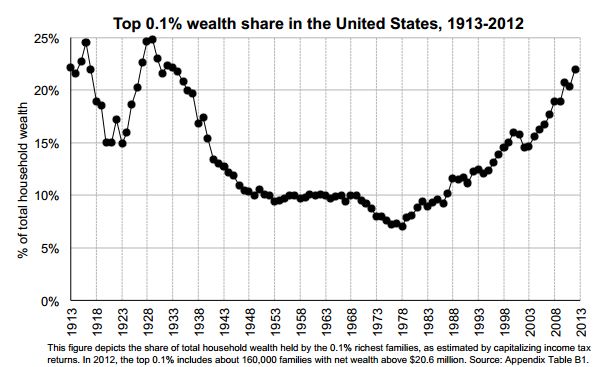

Warren Buffett is all about increasing income taxes for the wealthy, but you have never heard him talk about taxing the collected wealth of the wealthiest. It is easy for him to not pay himself an income, but it is very difficult for him to hide his basket of wealth. It appears that we are back to the imbalance that came right before the great depression:

Highly suggest you read the whole paper here.