Guest Post by JW Jones of OptionsTradingSignals.com

And if you look away, you’ll be doing what they say.

And if you look alive, you’ll be singled out and tried.

If you take home anything, let it be your will to think.

The more cynical you become, the better off you’ll be.

Something to believe in.”

~ The Offspring, Something to Believe In ~

The recent rally has been breathtaking, however the majority of investors have missed out on a large portion of these gains as significant levels of cash have been either moved to bond funds or taken out of equity markets consistently during this rally. Let’s face it, financial markets around the world are not what they once were.

U.S. equity markets in particular are manipulated by high frequency trading which is wreaking havoc in the marketplace in terms of potential short term volatility expansions and “flash crashes” that can be isolated to one underlying stock.

In addition to the high frequency trading robots, the Federal Reserve is equally involved in the direct manipulation of financial markets through record easing adjustments. The Federal Reserve has unleashed massive amounts of liquidity while keeping interest rates incredibly low which has produced an environment where the risk-on attitude permeates the landscape.

As a basic example of the failure of recent Federal Reserve policies and their impact generally on the valuation of various underlying assets, I submit for consideration to readers a 20 year price chart of the U.S. Dollar Index.

20 Year U.S. Dollar Index Chart

It boggles the mind to consider that Chairman Bernanke routinely denies that the Federal Reserve has failed to maintainwhat he calls “price stability.” When looking at the chart of the valuation of the U.S. Dollar against a basket of foreign currencies, most 5th graders if given the context would proclaim that the Federal Reserve has failed in their objective to maintain price stability.

As time passes and the financial crisis moves further into the rear view mirror, average Americans have varied views about the economy, the stock market, and trust in their government. For most Americans, the stock market does not make sense because they view the stock market and the economy as the same thing. Sophisticated investors understand that stocks and the economy are two totally separate issues, particularly with the amount of manipulation that has been taken place since 2007.

This manipulation has not gone unnoticed by the average American. Now more than ever regular people are not only distrustful of domestic financial markets, but they do not trust Wall Street, and for good reason. In light of this, data compiled during the recent uptrend suggests that retail investors have been pulling money out of equities for weeks even though prices continue to move higher. The chart shown below courtesy of ZeroHedge.com illustrates the recent trend.

U.S. Domestic Mutual Fund Flows

The chart above shows the price of SPY represented as the black line and equity fund inflows/outflows as the red area. As can be seen above, retail investors have been pulling massive amounts of capital out of equity based mutual funds over the past few months as equity prices have rallied. The retail crowd, commonly referred to as sheep or courtesy of Goldman Sachs “muppets,” are selling into the rally.

So why is the retail crowd selling? They do not believe that this rally will last because the real world around them is arguing in the face of everything that this rally stands for. Gasoline prices are crippling the lower and middle classes further reducing their disposable income. Higher food and energy prices paired with job scarcity and serious concerns have begun to mount.

The average retail investor believes the game is rigged at this point and the everyday investor is only helping Wall Street bankers fund their lavish lifestyles. Ultimately, the retail crowd likelybelieves that the only way to win the game is to simply not play.

Will time prove the supposed sheep wrong? Statistically one would think so, but in this case the retail folks may just be right. Headwinds surround the global macroeconomic landscape. Europe is moving into a recession which is being exacerbated by austerity measures. Data came out yesterday (Thursday) that the PMI in several European countries and China contracted. Ireland missed growth targets and central banks around the world continue to print unprecedented levels of fiat currency as if printing money and creating more debt will solve a debt problem.

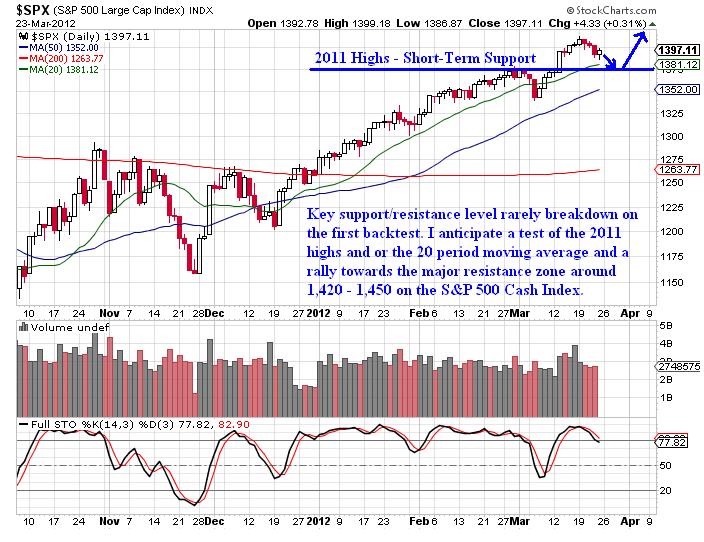

All of these issues are concerns, but ultimately price is the final arbiter in the world of flickering ticks. From these eyes there are two possible outcomes for the price action in the S&P 500. The first outcome which I believe is more likely is a test of the 2011 highs which results in a snap-back rally that takes us deeper into the 1,420 – 1,440 resistance zone. The chart below demonstrates the bullish potential outcome.

SPX Bullish Outcome

Price action at some point will backtest the 2011 highs and the reaction at that point will be critical. Generally speaking price action does not break a key support or resistance level on the first attempt. Usually the 2nd or 3rd attempt will result in a break of a key support / resistance level.

In this case, a test in coming days would likely result in a bounce and reversion to the previous trend. A possible, albeit unlikely outcome would be a break below the 2011 support zone which would then come close to triggering a trend change. The daily chart below demonstrates the bearish potential outcome.

SPX Bearish Outcome

I do firmly believe that the U.S. Dollar Index will hold clues about the future for the price action of equities. According to cycle analysis, the Dollar should come into is daily cycle low sometime in the next few weeks, if not sooner.

From that low, we should see another move higher for the Dollar Index which I anticipate will test the recent highs near 81. The daily chart of the U.S. Dollar Index futures is shown below.

U.S. Dollar Index Futures Daily Chart

If my expectations are somewhat accurate, the short term weakness in the Dollar will assist stocks and risk assets in a move above recent highs. In the case of the S&P 500, a move to key resistance at 1,420 – 1,450 could occur.

Readers should keep in mind that weakness could be disguised as just a consolidation near the 20 period moving average which has occurred in the past when analyzing the Dollar Index. However, I would not rule out one more leg lower before the Dollar finds a bottom.

Gold, silver, and the miners have been under selling pressure for some time and are likely due for a bounce to the upside. The weakness in the Dollar discussed above would allow precious metals and miners to work off some of the short term oversold conditions that we are seeing presently. The daily chart of gold futures is shown below.

Gold Futures Daily Chart

After a move higher into or around the $1,700 / ounce price level for gold, I believe that another leg lower will be quite likely.

Conclusion

Readers should be mindful that the 1st Quarter will end on March 30th for financial markets. Window dressing and portfolio painting are likely to occur next week. I would not be at all surprised to see the tape painted to the upside during the final week of March after this brief pullback that we witnessed on Thursday and Friday morning.

Money managers want to show off their returns while demonstrating ownership of key names that drove performance during the quarter such as AAPL. I expect the price action on Friday and the rest of next week to have relatively light volume and a bias to the upside.

Barring any major financial news or geopolitical event, I do not expect to see price action work below the 2011 highs in the near term. The possibility cannot be totally ruled out, but it would seemingly be a rare occurrence to see a major support level break down on the first back test attempt. We may see lower prices early next week, but if the 2011 highs hold the bulls remain in control in the short term.

The real question readers should ask themselves is if prices do extend higher and we reach my target resistance zone for the S&P 500, will the retail crowd jump in and push prices higher, or will the banks be trading with each other as a major top forms? In coming days and weeks we should find out once and for all just who the real muppets truly are.