Guest Post from Chris Vermeulen at TheGoldandOilGuy.com

Gold and silver along with their related miners have been under a lot of selling pressure the last few months. Prices have fallen far enough to make most traders and investors start to panic and close out their long term positions which is a bullish signal in my opinion.

My trading tactic for both swing trading and day trading thrive on entering and exiting positions when panic trading hits an investment. General rule of thumb is to buy when others are extremely fearful and cannot hold on to a losing position any longer. When they are selling I am usually slowly accumulating a long position.

Looking at the charts below of gold and silver you can see the strong selling over the past two weeks.When you get drops this sharp investors tend to focus on their account statements watching the value drop at an accelerated rate to the point where they ignore the charts and just liquidate everything they have to preserve their capital.

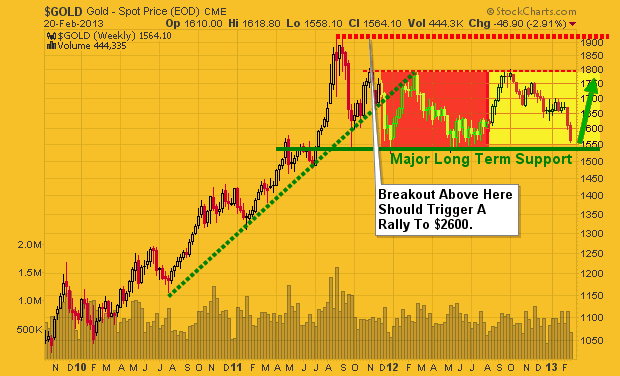

Gold Bullion Weekly Chart:

The price and outlook of gold has not really changed much in the past year. It remains in a major bullmarket and has been taking a breather, nothing more. Stepping back and reviewing the weekly chart it’sclear that gold is nearing long term support. With panic selling hitting the gold market and long termsupport only $20 – $30 dollars away this investment starts to look really tasty.

But if price breaks below the $1540 level and closed down there on a weekly basis then all bets are off as this would trigger a wave of selling that would make the recent selling look insignificant. And theuptrend in gold would now be over.

Silver Bullion Weekly Chart:

Silver price is in the same boat as its big sister (Yellow Gold). Only difference is that silver has larger price swings of 2-3x more than gold. This is what attracts more traders and investors but unfortunately the masses do not know how to manage leveraged investments like this and end up losing their shirts.

A breakdown below the $26.11 price would likely trigger a sharp drop back down to the $17.50 level so be careful…

Gold Mining Stocks – Monthly Chart:

If you wanna see a scary chart then look at what could happen or is happening to gold miner stocks. This very could be happening as we speak and why I have been pounding the table for months no to get long gold, silver or miners until we see complete panic selling or a bullish basing pattern form on the charts. We have not seen either of these things take place although panic selling is slowly ramping up this week.

There will be some very frustrated gold bugs if they take another 33% hair cut in value…

Precious Metals Trend and Trading Conclusion:In short, the precious metal sector remains in a cyclical bull market. That being said and looking at the daily charts the prices have been consolidating and are in a down trend currently. Until we see some type of bottoming pattern or price action form it is best to sit on the side lines and watch the emotional traders get caught up and do the wrong thing.

The next two weeks will be crucial for gold, silver and miner stocks. If metals cannot find support and close below the key support levels things could get really ugly fast.