Often it is worth taking a step back and assessing the big picture. ZeroHedge left its readers with a P/E10 Valuation Chart from dshort.com that leaves you feeling a little uneasy:

ZeroHedge: "US Retail Investor - Do You Feel Lucky?"

Aside from valuations, what has left me uneasy is the incredible decline in both historic and implied volatility. All is right in the world again. The theft of deposit Euros in Cyprus caused a little less than a hiccup. The volatility on the S&P 500 was about 12.7% Year to Date 2013 has been dampened further to a modest 10.2%

The reality is that we are in a de-leveraging environment. Consumer debt has fallen, but government debt has gone through the roof as an offset. The overall debt is a major headwind that causes low growth and a precarious market environment. Japan is a foreign example that could be considered to have had a better starting point than our own:

Can the Federal Reserve truly prevent us from experiencing the same levels of volatility following the Great Depression or the Japanese asset bubble?

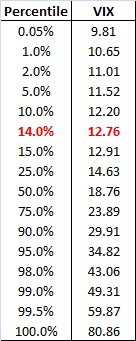

In a less subjective measurement, just where are we compared to historic volatilities? Below the 20th percentile on the short end of the implied volatility curve:

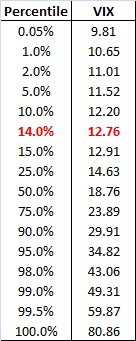

The lopsided tail in the distribution can be better represented using a chart:

The lopsided tail in the distribution can be better represented using a chart:

- Reversion to the middle?

So in summary:

- US Valuations are in the upper quintile

- US Volatility is the in the lower quintile

- The Eurozone is showing less stability and more destructive policy actions

Do you want to add or reduce risk?