Statistics are always fun for politicians because they can be manipulated to seemingly portray the message that they would like to relay to the broader public. The message or prolific meme of the election cycle and “Occupy Wall Street” movement was the “The Top 1% are grossly overpaid and should share more the burden”. Dig into the statistics a little bit and the message is quite different.

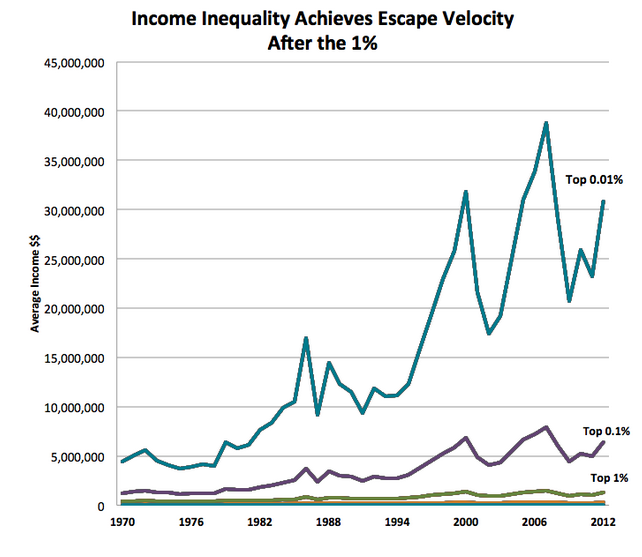

The income of the top 1% is stagnant in comparison to the top .1% and .01%:

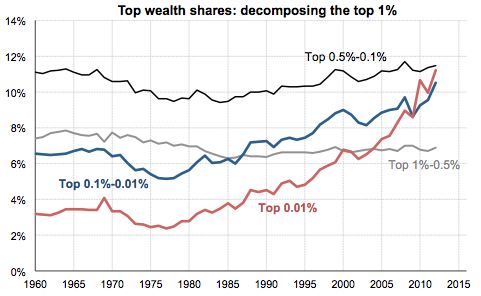

The share of wealth of the top 1% could even be called stagnant compared to the super rich:

In the statistics, the averages of the 1% are skewed by the outlier readings of the .01%. Buffett will continue to state that taxes on the top 1% should be raised, because they will not impact him because he doesn’t take a salary – he just rides his increase in wealth through increase share price of his stock ownership. The only political fix to the quadrupling of wealth ownership of the top .01% is to place a small tax on total wealth (above a high hurdle) which would reduce the amount of tax evasion achieved by the top .01% by owning companies and lowering their amount of wealth treated as taxable “income”.

Article: Atlantic