I am always looking for confirmation that option selling strategies perform well over time and I have focused most of my time on US markets. In general, I have found that selling strangles or straddles on the S&P 500 has been very profitable through market cycles. Please refer to my previous article for that proof.

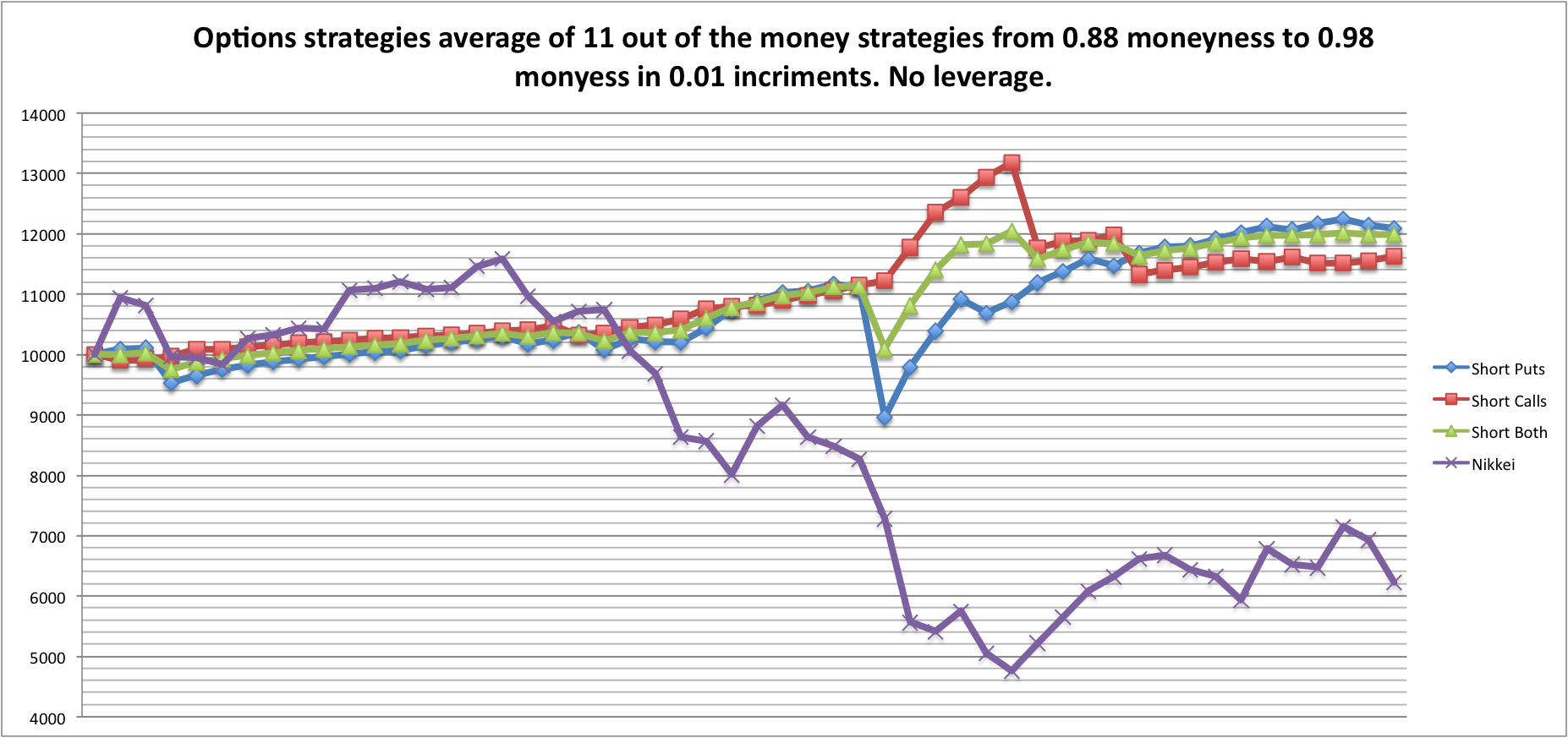

In a similar vein a fellow blogger has looked at selling options on the Nikkei from March 2006 to June 2010 for his master’s thesis. He also finds that the results are quite robust, especially compared to a long only position on the Nikkei.

Hopefully he will be able to gain access to the full set of data and expand out the study. Considering the fact that many investors feel that the United States is following Japan’s deflationary scenario, it would be very interesting to see how an option selling strategy worked from the Japanese bubble bust in 1990 through today. Read the full article here.