There was a confluence of global factors that caused equity markets to “freak” out in May. Inflation scares and slowing demand in China, sovereign debt issues in Europe, British Petroleum’s inability to slow or stop its Gulf oil spill, and the “flash crash” of May 6th. Where there are freakouts, there are opportunities.

I often talk about the short-term measure VIX as an indicator of when to short volatility, or looking at an even better indicator through option skew. We tend to focus on short-term implied volatility because the information is readily available and transparent, plus option sellers love the theta or time decay from the shorter dated options. This bias will allow us to overlook other lucrative opportunities.

It turns out that one year variance on the S&P 500 had its largest monthly spike over the past 20 years and this came at a time when the S&P was only down about 10%. As we saw during May, realized volatility in the short-run can be extreme, but eventually the markets always settle down. This is why the mean-reversion of volatility will sometimes make you prefer to sell long-dated options. In the next month, there could be some very bad news events that cause realized volatility to spike over 35% again, but I would have a very hard time believing that over the next two years we would see two year realized volatility come in at 35%.

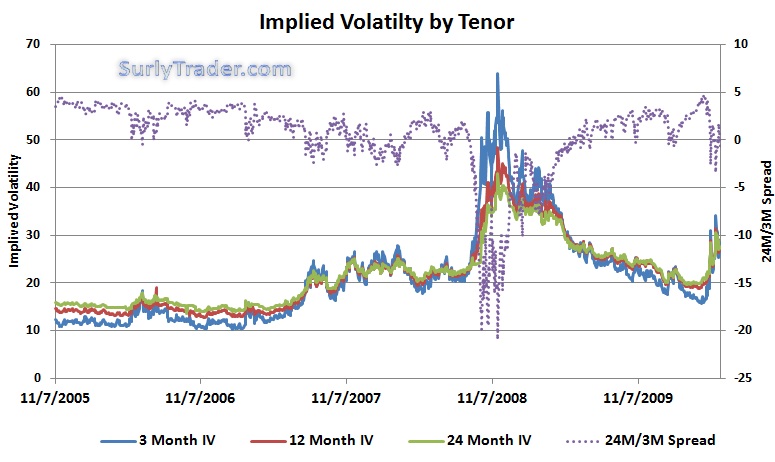

So what does long dated implied volatility look like versus short term implied volatility?

Opportunities:

- It turns out that during this time period the 24-month implied volatility is over 50bps higher than the 3-month implied volatility. You can argue that this has to do with the greater uncertainty surrounding the next 2 years versus the next 3 months. You could also argue that this has more to do with fewer sellers (supply) of 24-month options versus 3-month options. I think it is probably a combination of the two.

- During the crisis of 2008 the spread between 24-month IV and 3-month IV became largely negative (20% gap). This is contrary to argument 1 and probably has more to do with the market understanding that realized volatility is mean reverting and it is very very difficult to think that volatility over the next 2 years will be 60%. That said, 2008 provided an excellent opportunity to sell 2 years worth of 30%+ implied volatility.

- The recent spike in implied volatility came after the spread between 24M and 3M became its largest positive. This means that investors continued to buy longer dated protection even while the VIX and realized volatility sunk to multi-year lows. Was this a great signal? Should you have bought short term implied volatility outright, or bought short-term implied volatility and sold long-dated implied volatility in a vega-neutral position?

- After volatility recently spiked, the spread did not become highly negative like it did in 2008. The longer-dated volatility was already bid up and moved quickly with the short-term IV and realized volatility. This, in my opinion, provided a great opportunity to sell long-dated implied volatility.

From a practical standpoint, long-dated implied volatility is much easier to swallow. Longer options allow you to sell puts and calls much further out of the money to collect the same premium. They also have less gamma risk, so when the markets move against you, your option positions do not move as quickly against you. For the more sophisticated investors, they are much easier to delta hedge because of that lower gamma risk. The delta is more static, so the rebalancing is less frequently required.

Long dated options might not be the most sexy options to sell, but maybe that is why they often seem to be more attractive.

Next Up: Volatility Cones.