It seems rather unfortunate that the hack of an AP twitter account can cause more of a disturbance in the market than an actual terrorist bombing in Boston. A 15+ point dive based upon hacked falsehoods:

It seems unlikely that today’s rally was a recovery and continuation of the rally that we have experienced since the middle of November. In fact, it seems likely that today’s rally was more of a short-covering fueled bounce than a continuation of something “good”:

It seems unlikely that today’s rally was a recovery and continuation of the rally that we have experienced since the middle of November. In fact, it seems likely that today’s rally was more of a short-covering fueled bounce than a continuation of something “good”:

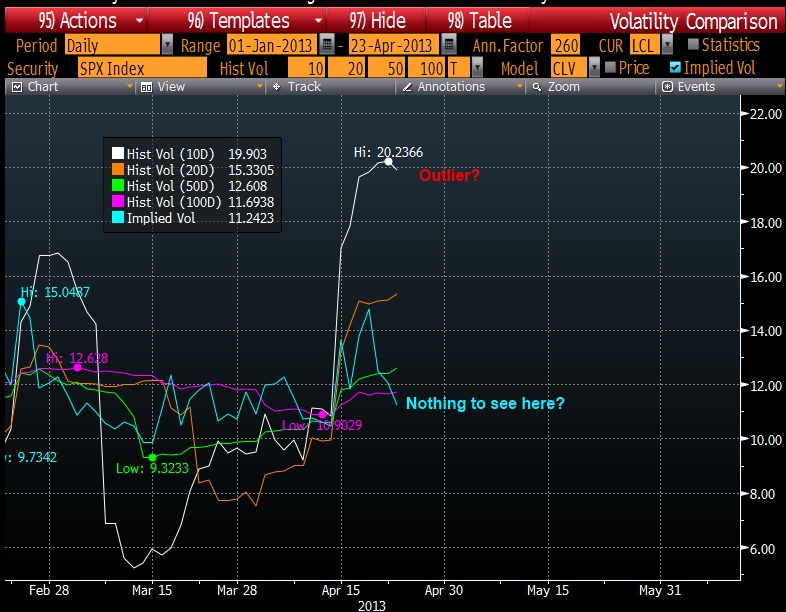

What is actually kind of entertaining in this market is the complete apathy in options and implied volatility. 10 Day realized volatility has ramped up to 20%+, but the VIX dropped to 13.48%. I might be Naive, but I have found that the best indication of future volatility is recent volatility…

What is actually kind of entertaining in this market is the complete apathy in options and implied volatility. 10 Day realized volatility has ramped up to 20%+, but the VIX dropped to 13.48%. I might be Naive, but I have found that the best indication of future volatility is recent volatility…

I am not biting. Euro was down today, gold is slanting negative once more, DBA (agriculture commodity ETF) was down about 1% today. Doesn’t seem like a happy picture going into a temperamental season.