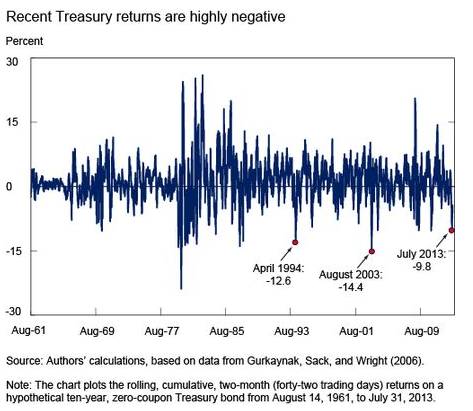

The recent decline in bond prices has been significant, but actually not on the highest end of selloffs since 1960. The selloff of a 10 year zero coupon treasury over a 10 month time period is in the bottom distribution, but not extreme by any means:

Despite the unprecedented actions through quantitative easing and the market’s recent interpretation that the fed might lift off the gas pedal, the pace of the selloff is actually a bit slower than it was in 2003:

So I guess for now, we can stop concerning ourselves with early 1980’s price action. We just aren’t there yet.