Bill Gross is usually in the know with an inside ear. When Bill Gross decides to dump all of his treasury securities that gives me a bit of a pause regarding treasury rates.

The world’s largest bond fund dumped all of its U.S. government debt in the biggest signal yet of how negative investors have become about the U.S. Treasury market.

The move by Bill Gross’s $236.9 billion US PIMCO Total Return fund comes in the wake of a vicious Treasury market sell-off and just days after he questioned who will buy Treasuries once the Federal Reserve halts its latest round of bond purchases in June.

I believe that this negative stance on treasuries probably is related to Bill’s view that an end to quantitative easing could lead to a jump in interest rates:

A successful handoff from public to private credit creation has yet to be accomplished, and it is that handoff that ultimately will determine the outlook for real growth and the potential reversal in our astronomical deficits and escalating debt levels. If on June 30, 2011 (the assumed termination date of QE II), the private sector cannot stand on its own two legs – issuing debt at low yields and narrow credit spreads, creating the jobs necessary to reduce unemployment and instilling global confidence in the sanctity and stability of the U.S. dollar – then the QEs will have been a colossal flop. If so, there will be no 15%+ tip for the American economy and its citizen waiters. An inflation-adjusted “negative buck” might be more likely.

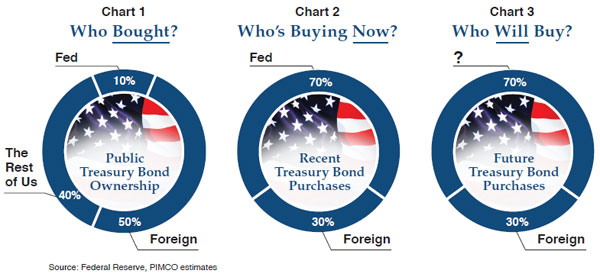

Washington, Main Street – and importantly from an investment perspective – Wall Street await the outcome. Because QE has affected not only interest rates but stock prices and all risk spreads, the withdrawal of nearly $1.5 trillion in annualized check writing may have dramatic consequences in the reverse direction. To visualize the gaping hole that the Fed’s void might have, PIMCO has produced a set of three pie charts that attempt to point out (1) who owns what percentage of the existing stock of Treasuries, (2) who has been buying the annual supply (which closely parallels the Federal deficit) and (3) who might step up to the plate if and when the Fed and its QE bat are retired. The sequential charts 1, 2 and 3 are illuminating, but not necessarily comforting.

It certainly does make you wonder how likely it is that we will witness a round 3 of quantitative easing. If interest rates rise too rapidly too soon in the recovery, then we could see quite the stumble…

It certainly does make you wonder how likely it is that we will witness a round 3 of quantitative easing. If interest rates rise too rapidly too soon in the recovery, then we could see quite the stumble…