There are very few retail investors that actually delta-hedge option positions. For today’s task, we will take a very simple example to illustrate just what it means to delta hedge a position and how to account for profitability. In this example we will look at the last few weeks of trading in the S&P 500 ETF (SPY) and a May expiration put with a strike price of $140. You can download the data for the underlying ETF and option from the source of your choice, but usually you will have to use an excel function or macro to calculate the delta and implied volatilities corresponding to the option prices:

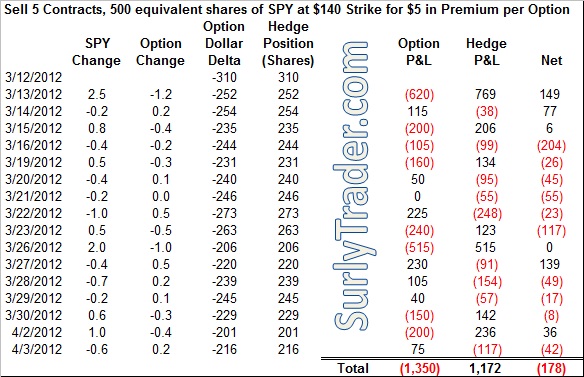

When we are delta hedging the option, we want to make the position delta neutral – meaning that we would no longer care what happens to our net position for small movements in SPY. If we look at the inception of the trade, the delta of the long put option is -.62, which means that we lose 62 cents for every option that we bought when the underlying (SPY) goes up by just 1 point or 1 dollar. Since our position is long 500 options, or 5 contracts, we have a delta position of -$310 (500*-.62). To offset this position and become delta neutral, we should purchase 310 shares of the underlying, SPY at the close of the trading day on March 12th. We will rebalance this position on every single trading day through April 3rd and look at the results:

When we are delta hedging the option, we want to make the position delta neutral – meaning that we would no longer care what happens to our net position for small movements in SPY. If we look at the inception of the trade, the delta of the long put option is -.62, which means that we lose 62 cents for every option that we bought when the underlying (SPY) goes up by just 1 point or 1 dollar. Since our position is long 500 options, or 5 contracts, we have a delta position of -$310 (500*-.62). To offset this position and become delta neutral, we should purchase 310 shares of the underlying, SPY at the close of the trading day on March 12th. We will rebalance this position on every single trading day through April 3rd and look at the results:

If you are new to delta hedging, I suggest that you spend some time thinking about these numbers. You should notice that we make money when implied volatility goes up and/or when the SPY moves a lot (which didn’t happen very much in this time period). I will also give you the broad theme of this trade: we bought implied volatility at 14.2%, delta hedged the position over multiple days and lost $178. The biggest reason that we lost money is that we bought implied volatility at 14.2% and experienced an annualized volatility of just 11.1%. When you purchase options and delta hedge you want realized volatility to be higher than what implied you bought the option at. When you sell options and delta hedge you want realized or experienced volatility to be lower than the implied volatility that you sold the options at.

If you are new to delta hedging, I suggest that you spend some time thinking about these numbers. You should notice that we make money when implied volatility goes up and/or when the SPY moves a lot (which didn’t happen very much in this time period). I will also give you the broad theme of this trade: we bought implied volatility at 14.2%, delta hedged the position over multiple days and lost $178. The biggest reason that we lost money is that we bought implied volatility at 14.2% and experienced an annualized volatility of just 11.1%. When you purchase options and delta hedge you want realized volatility to be higher than what implied you bought the option at. When you sell options and delta hedge you want realized or experienced volatility to be lower than the implied volatility that you sold the options at.