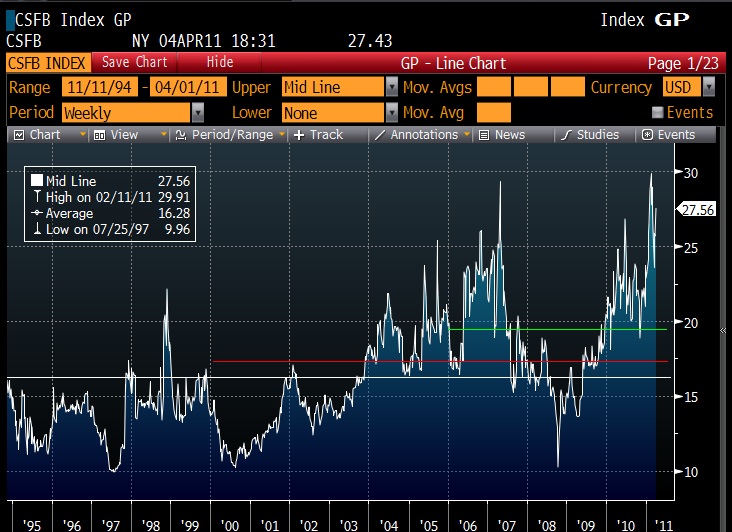

With such few signs of pessimism in the media, I thought I might be the wet blanket for the day. One interesting market sentiment measure is the Credit Suisse Fear Barometer. The Fear Barometer is a way to measure skew in a consistent format through the pricing of a “zero-cost collar”. The index assumes that you sell a 3-month, 10% out of the money call and use the proceeds to purchase a 3-month out of the money put. The moneyness of the put option that you can afford is the index itself, so if the index is at 25 it implies that you can purchase a 3-month put 25% out of the money with the premium that you received from selling the 10% OTM 3 month call.

Since index inception in November of 1994, this average level has been 16.3%. With the market turbulence of the last five years, the average has been closer to 19%. The interesting fact is that since January of this year, the index has primarily been above 25%, a level that it was at during only a few times in its 15+ year history. One of the most notable peaks of similar stratospheric levels – April 2007, a time that would have presented an excellent opportunity to exit the market.

Of course there is no one perfect predictor of market tops and bottoms, but I will say that this peak stands out and should be noted. It certainly does not give me a comfortable backdrop for being overly bullish.