Many traders find options to be exciting because of the implicit leverage within the securities – buy $500 worth of options and control a potential $120,000 investment. That is only one small aspect of option trading and it is a very limited viewpoint. Options are truly great because they provide an infinite number of investment strategies for those willing to look. One aspect often ignored is the term structure of volatility which is a view across option maturities.

An intriguing relationship can be found between long-dated maturities and short-dated maturities. Despite a rapid fall of the media-friendly VIX, longer dated options have kept their lofty implied volatility levels. If we focus just on one year and one month ATM options on the S&P 500, we can see how lofty that relationship is:

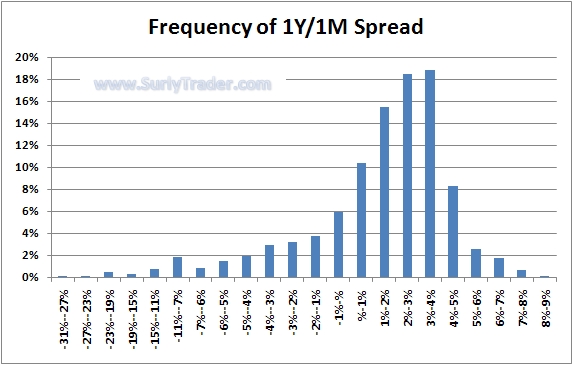

The spread between the 1 year option implied volatility and 1 month options is quite wide, but looking at the standard deviation is probably the wrong metric when looking at a risk factor with such fat tails. A better metric might be to look at a distribution of spreads:

The gap between 1 year and 1 month implied volatility can go highly negative, but on the positive end of the spectrum it seems strongly capped. We can see that about 85% of observations occur between -3% and +5% while only 5% of daily observations ever came in at a reading of greater than a 5% gap. This implies that our current spread of 5.5% provides an opportunity.

How to take advantage of this opportunity? Sell a 1 year option straddle, buy a 1 month option straddle vega neutral and delta hedge the position. A simpler method would be to go long VXX and sell VXZ or similar in VIX futures.