- Economic Data Frozen Until Next Thursday

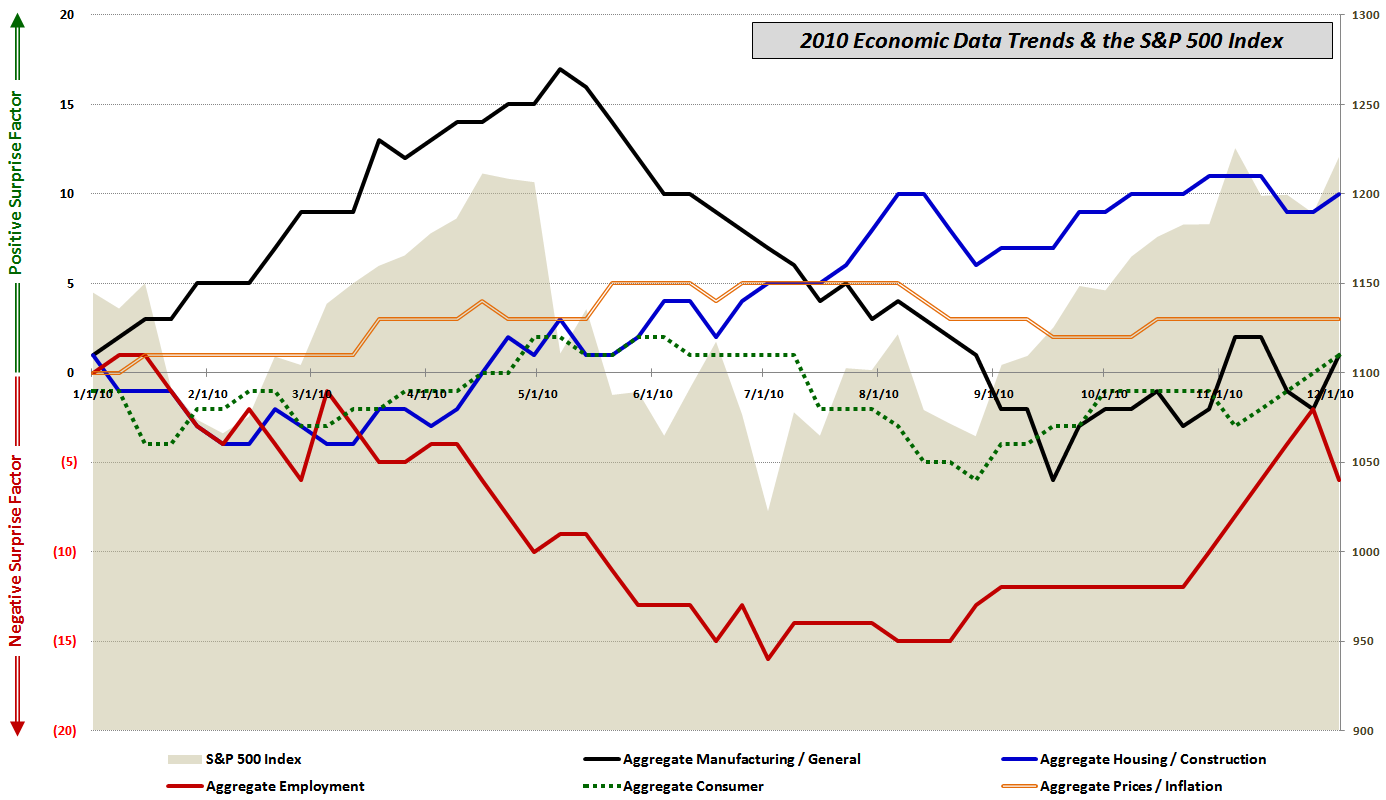

Today’s data dump of nonfarm payrolls, the ISM non-manufacturing survey and factory orders caps a big week for economic data and since there is an unusually long stretch until the next data points are released ( next Thursday’s jobless claims), this seems like a good time to update my ongoing chart of economic data relative to expectations.

The last time I updated this chart, in late October, I observed, “There has been a noticeable uptick in positive reports since the beginning of September – one that just so happens to coincide with the upturn in stocks.” Today’s nonfarm payrolls report notwithstanding, the pattern of positive surprises has been repeated through November and into the first week of December. While employment continues to be the biggest story, the recent uptrend in the consumer and resurgence in manufacturing mitigates some of the bad news on the labor front and hints at the possibility of a job market that may show signs of improvement soon.

The other big story in this chart is that as bad as housing and the construction market seem, the data has consistently been coming in higher than the lowered consensus expectations.

Finally, it is rare that there is dearth of data in the U.S. for such an extended period of time. Among other things, this lack of new data points means that any investing trends that are currently in place will have little in the way of evidence to undermine their validity during the next week. It also means that the Fed will have little in the way of additional new information in front of them when the FOMC meets on Tuesday, December 14th.

Related posts:

- More Upticks in Economic Data vs. Expectations

- Economic Data Trends Improving

- Chart of the Week: Updated Economic Data Trends

- Economic Data Trends in Advance of Nonfarm Payrolls

- Trends in Economic Data Relative to Expectations

Disclosure(s): none

Disclosure(s): none - VIX List-a-Palooza

Remember not that long ago when you could only trade volatility by actually trading options? Well, those dark days are a thing of the past as every financial institution known to man seems to have a volatility product they’d like to list. In the past week alone, we’ve had six offerings from Velocity Shares, one […]

- Your VIX Sonar

There’s actually a spike in volatility going on. Volatility OF volatility I should note. Most confusing concept ever? Possibly. What that means is options ON VIX have seen implied volatility spike. Specifically in January and February. Jamie notes VIX put buyers, and 1:2 call spread buyers. There’s almost a permanent bid on cheapo VIX call […]

- Two More VIX ETNs Makes It a Baker’s Dozen

In addition to the six new VIX-based ETNs launched yesterday by VelocityShares, two new VIX-based ETNs also traded yesterday for the first time.

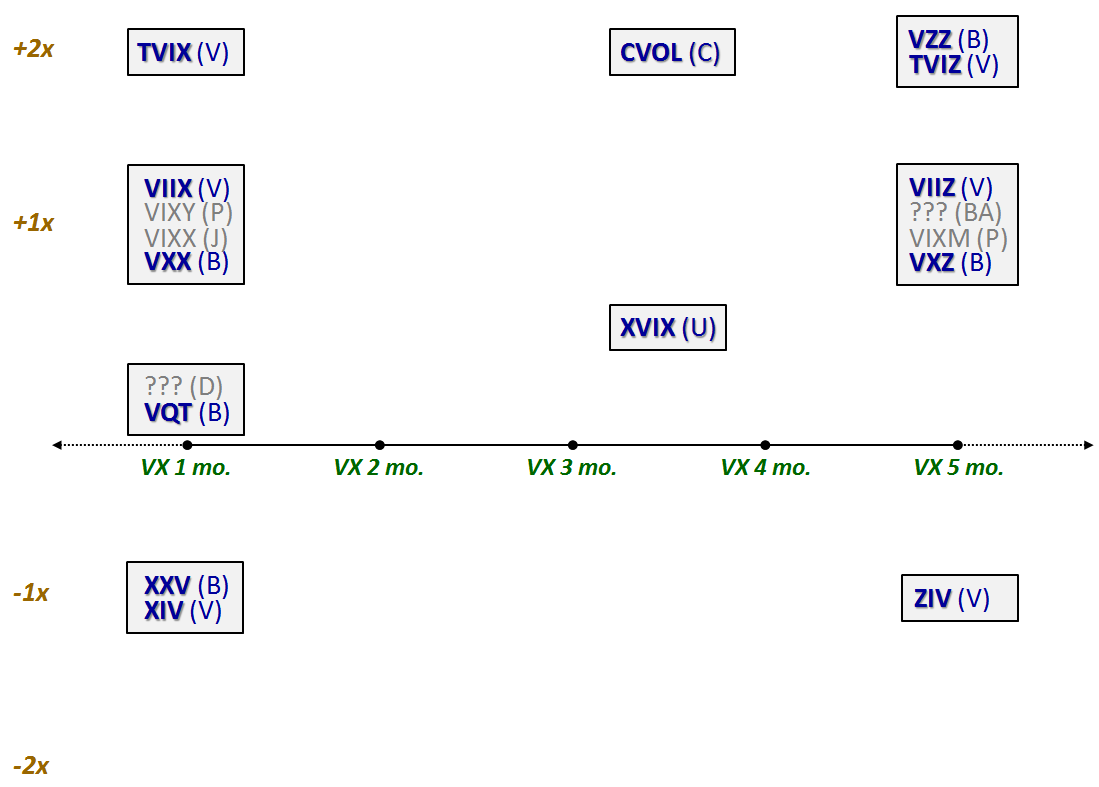

Barclays added VZZ to their product lineup, bringing the total number of Barclays products in the space to five. VZZ is essentially a +2x version of VXZ, with a target maturity of five months. VZZ is the first leveraged volatility ETN from Barclays and is interesting in that the absence of a corresponding +2x VXX product suggests Barclays does not see the need for a leveraged VXX equivalent or perhaps finds the combination of leverage and high contango at the front end of the VIX futures term structure to be a daunting combination.

Elsewhere, UBS makes its entry into the VIX-based ETN fray with a huge splash. Their new product, XVIX, ups the innovation ante by combining a 100% long position in the S&P 500 VIX Mid-Term Futures Excess Return Index with a 50% short position in the S&P 500 VIX Short-Term Futures Excess Return Index. Translated into Barclays terms, this would be roughly the equivalent of two units long VXZ and one unit short VXX. Depending upon the shape of the VIX futures term structure, UBS is hoping that XVIX will benefit from contango and also get a lift from an increase in volatility. The performance of XVIX going forward will be particularly interesting to watch.

I would expect the land grab in the volatility ETP space to settle down for a little while as investors evaluate the new menu of options. In the meantime the chart below should help. I have grayed out those products which have been announced, but not launched.

The most difficult part may be unlearning Roman numerals in the process. I’m sure on some trading floor, however, some joker is yelling out, “I’m long 25 and 15, but short 70.”

Related posts:

- Impressive Launch for Sextet of New Volatility ETNs from VelocityShares

- VelocityShares Jumping in to VIX ETP Space with Leveraged and Inverse Products

- The Evolving VIX ETN Landscape

- Interesting New Leveraged Volatility ETN Coming from Citi

Disclosure(s): short VXX at time of writing

Disclosure(s): short VXX at time of writing

Today’s Option Blogs December 4, 2010

Posted in Markets.

Tagged with blogs, Derivatives, Options, skew, trading, Volatility.

Comments Off on Today’s Option Blogs December 4, 2010

By SurlyTrader – December 4, 2010