I have read a few articles that defend the rising costs of college, specifically looking at the current differentials between the lifetime earnings of those with college degrees and those without. These types of comparisons only make me think of the “Old Economy Steve” meme floating around with the younger generations:

The focus on current graduates has excludes all comparisons to previous generations. Unfortunately, there are some realities that make Old Economy Steve pretty annoying. For one, student debt levels are on a trajectory that trumps credit cards and auto loans:

The focus on current graduates has excludes all comparisons to previous generations. Unfortunately, there are some realities that make Old Economy Steve pretty annoying. For one, student debt levels are on a trajectory that trumps credit cards and auto loans:

![types of debt[1]](http://surlytrader.com/wp-content/uploads/2013/06/blog_student_loan_debt.jpg) The cost of college tuition in the United States is 2nd only to Switzerland:

The cost of college tuition in the United States is 2nd only to Switzerland:

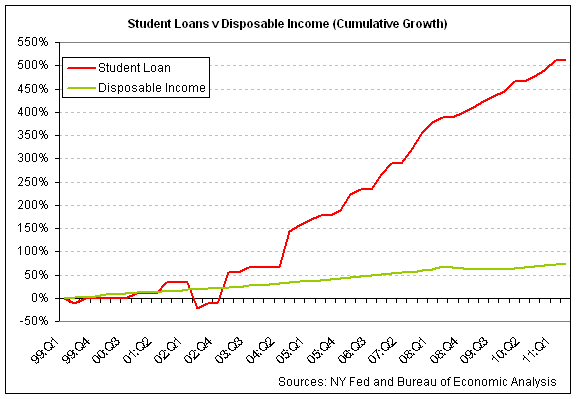

And most importantly the cost of education compared to disposable spending has reached a record gap:

And most importantly the cost of education compared to disposable spending has reached a record gap:

As with all unsustainable growth paths, the student loan market will hit a wall. The only questions are 1) When and 2) What are the repercussions?

As with all unsustainable growth paths, the student loan market will hit a wall. The only questions are 1) When and 2) What are the repercussions?

The immediate result is that current graduating students have a debt yolk around their necks. The future market results are currently unknown, but it is almost certain that college students in the future should find cheaper tuition after the student debt bubble deflation forces lower tuition costs.