It seems amusing that a contagion that has been known since the end of 2009 has just recently been embraced by the markets. Nothing in this story is new, yet equities act as if the end of the world has just been revealed. Long ago, I said that we can “Expect the Unexpected” and bouts of higher volatility will continue to persist for many months and even years to come. Private debt has been swallowed by public obligations and now we get to experience the many jitters associated with sovereign defaults…

If someone were to ask me where the next “crisis” will emerge, I would say that it would most likely be the municipal debt overload in the United States. Spreads on the new and beloved Build America Bonds (BABS) are in the low 100’s, but I expect that we will see a spike in that credit risk by the end of the year. What do you think the outcome will be? Do you think states and municipalities will actually cut costs associated with pension obligations and public “servant” salaries? The salaries and benefits of those doing the public good? The salaries of those who make up a large voting population for those seeking re-election?

One thing that I will make a bet on is that the dollar will not hold its lofty ground. Once the European crisis is settled, I expect that the dollar will lose favor rapidly.

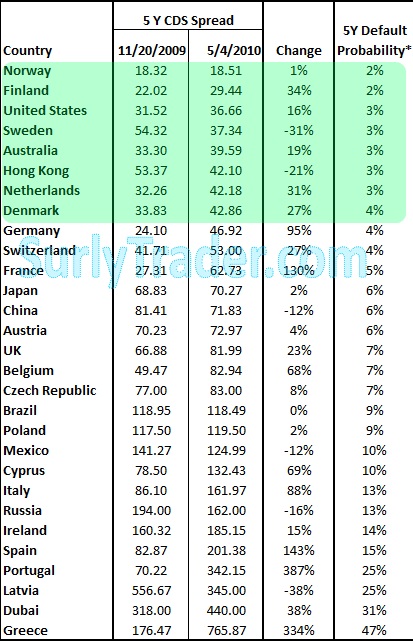

Look for those countries with low debt ratios and sound fiscal policy. You can spot them easily by looking at current credit spreads on the sovereign nations.