We get a lot of information on the job market, but few studies specifically focused on one profession. The Economic Modeling Specialists spent some time to focus specifically on the Lawyer market. What is not surprising to me is that DC again comes in as the strongest labor market….strongest housing market…strongest incomes….wonder why?

23% All Goods and Services Since 1AD Produced from 2001 to 2010

This is obviously due to the exponential growth of people along with increased efficiencies in production. I would like to think that new discoveries in philosophy, mathematics and physics would take precedence over “things” in importance.

Read the full article here.

Read the full article here.

Posted in Economics.

Comments Off on 23% All Goods and Services Since 1AD Produced from 2001 to 2010

– June 29, 2011

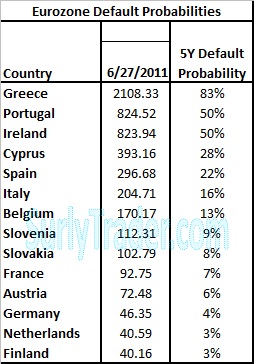

Greece, Portugal, and Ireland Default Probabilities Above 50%

I see headlines like, “Euro Maintains Gain on Greek Debt Optimism” and I am just not sure what everyone else is looking at. As far as the credit default swap market is concerned, Greece has already defaulted, it is just a matter of when and in what form. Ireland and Portugal are basically at levels that share a similar fate. Next question is whether Italy and Spain fall into the hole.

Posted in Economics, Markets, Media, Politics.

– June 27, 2011

Noteworthy News – June 27, 2011

Economy:

Why So Glum? Economic Optimism Dims – NPR

Bridge Comes to San Francisco With a Made-in-China Label – New York Times

Why the Jobs Situation Is Worse Than It Looks – US News

How it went so wrong in America – Salon

Markets:

How the mortgage industry lies with statistics – Reuters

Coughs and sneezes: A Greek default could precipitate defaults in other euro-area countries – Economist

Asian Stocks Fall, Led By Banks – Bloomberg

Politics:

Enter the dragon ‘to save the euro’ – The Telegraph

All hail the progressive consumption tax! – Economist

To default, or not to default? – Economist

Banks:

The Magnetar Trade: How One Hedge Fund Helped Keep the Bubble Going -Propublica

Bigger, Safer, More Regulated – Slate

Central bankers: Big banks must keep more capital – MarketWatch

Posted in Economics, Markets, Media, Politics.

Comments Off on Noteworthy News – June 27, 2011

– June 26, 2011

Far Cry from a Panic

Despite the tumultuous economic news, rapidly falling treasury rates, and a skittish stock market, we have yet to see the levels of implied volatility that we saw last summer over similar Greek concerns. This either is telling us that the equity and options markets believe that the fears are overblown and that the bull market is intact, or we should expect the green and the blue line to converge faster than expected. I am still betting on the latter.

Trading VIX Derivatives: Trading and Hedging Strategies Using VIX Futures, Options, and Exchange Traded Notes (Wiley Trading)

A guide to using the VIX to forecast and trade markets

Known as the fear index, the VIX provides a snapshot of expectations about future stock market volatility and generally moves inversely to the overall stock market. Trading VIX Derivatives will show you how to use the Chicago Board Options Exchange’s S&P 500 volatility index to gauge fear and greed in the market, use market volatility to your advantage, and hedge stock portfolios. Engaging and informative, this book skillfully explains the mechanics and strategies associated with trading VIX options, futures, exchange traded notes, and options on exchange traded notes.

Many market participants look at the VIX to help understand market sentiment and predict turning points. With a slew of VIX index trading products now available, traders can use a variety of strategies to speculate outright on the direction of market volatility, but they can also utilize these products in conjunction with other instruments to create spread trades or hedge their overall risk.

- Reviews how to use the VIX to forecast market turning points, as well as reveals what it takes to implement trading strategies using VIX options, futures, and ETNs

- Accessible to active individual traders, but sufficiently sophisticated for professional traders

- Offers insights on how volatility-based strategies can be used to provide diversification and enhance returns

Written by Russell Rhoads, a top instructor at the CBOE’s Options Institute, this book reflects on the wide range of uses associated with the VIX and will interest anyone looking for profitable new forecasting and trading techniques.

Posted in Economics, Markets, Media.

Comments Off on Far Cry from a Panic

– June 23, 2011