The action today was highly negative and I would contribute that to the absolutely recessionary level of the Philly Fed. I am going to hold off on the fear mongering because even if we are in a recession, I question just how deep it could get after such a tremendous retraction in consumer spending, massive decline in real estate prices, abundance of cash on US corporate balance sheets, and excess financial liquidity in the system.

The true question is how bad could a secondary recession be? The big jolts have already been swallowed (though banks are still trying to hide losses on the balance sheet). Now we have to slowly chug our way through high government debt burdens in developed nations. The only feasible global scenario that would cause the liquidity squeeze of 2008 would be complete political brinkmanship in the eurozone. I guess it just depends on how much national pride these Eurozone “states” have.

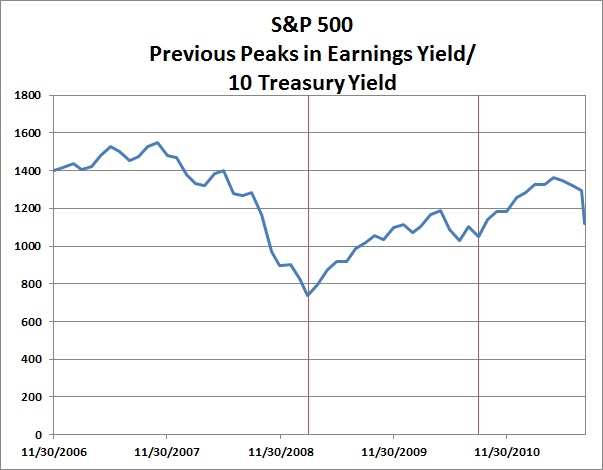

Anyway – a little bit of humor and honesty to lighten the mood: