Economy:

Middle class woe – HarvardGazette

Global debt: How worried should we be? – BBC

Report: Billionaires are hoarding mountains of cash – UPI

Santa’s real workshop: the town in China that makes the world’s Christmas decorations – Guardian

Modern Moms Aren’t as Busy as 1960s Moms Were – Atlantic

Markets:

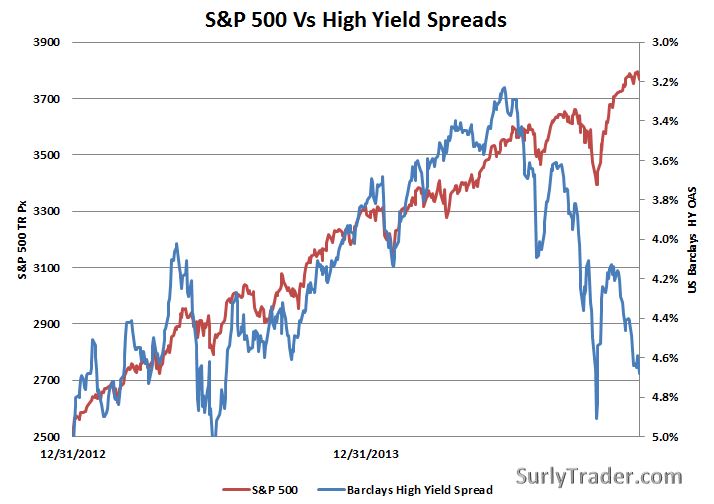

The Markets Are Predicting a Venezuelan Default – Bloomberg

Here’s why oil companies should be a lot more profitable than they are – Reuters

Bankers See $1 Trillion of Zombie Investments Stranded in the Oil Fields – Bloomberg

Politics:

That’s rich! Why so many wealthy Americans think they’re middle class – Salon

The week the dam broke in Russia and ended Putin’s dreams -Telegraph

Of Kiwis and Currencies: How a 2% Inflation Target Became Global Economic Gospel – New York Times

Banks:

A black hole for our best and brightest: Wall Street is expanding, and the economy is worse off for it – Washington Post

Big banks need to embrace digital era – Financial Times

How Wall Street is chipping away at reform – The Week