Economy:

Youth unemployment could tear Europe apart, warns WEF – Telegraph

Alcohol Obesity and Smoking Do Not Cost Health Care Systems Money – Forbes

Monetary policy has not been ultra-loose – Economist

China’s Going To Get Old Before It Gets Rich – NPR

The Money Trap – New York Times

Markets:

How We Can Stop Hospitals From Over-Billing – HuffingtonPost

Germany’s hyperinflation-phobia – Economist

Politics:

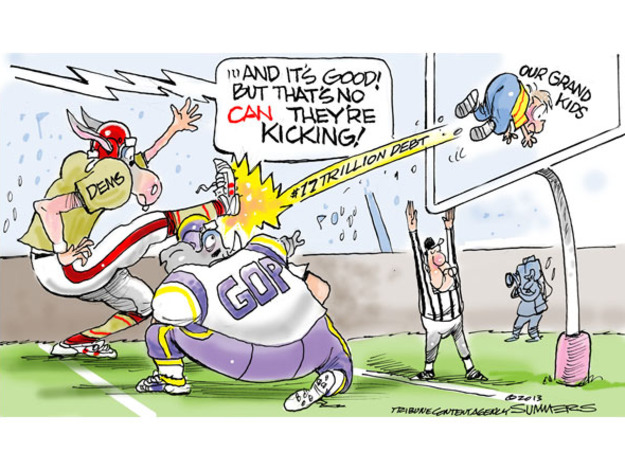

U.S. Doesn’t Have a Spending or Deficit Problem – Real Clear Politics

GOP’s ignorance of economics: Even more dangerous than realized – Salon

Banks:

Banks to repay 3.6 billion euros of crisis loans: ECB – Reuters