Economy:

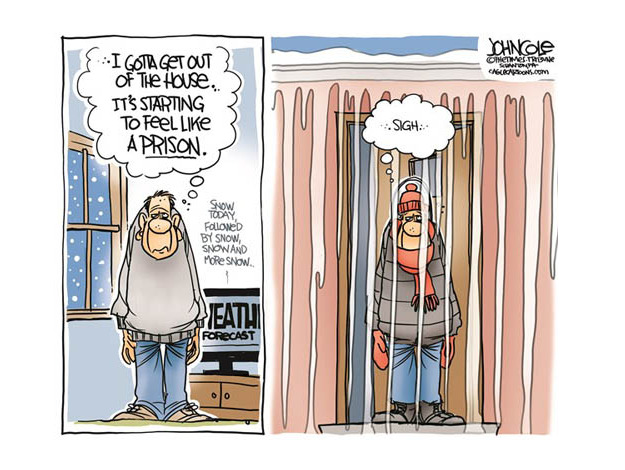

Is Bad Weather Behind Weak US Economic Trends? – Mises Institute

The Invention Of ‘The Economy’ – Planet Money

Markets:

Markets brace for Ukraine-Russia crisis impact – Globe and Mail

Growth and Interest Rates: I Appear To Be Wrong – New York Times (Krugman)

How history explains bitcoin, Mt. Gox bankruptcy – MarketWatch

The curious case of China’s falling yuan – BBC

Politics:

A serious tax-reform plan and its discouraging reception – Washington Post

Japan’s Ambitious Economic Revival Plan Is Running Into Big Problems – Business Insider

Like It or Not, 90 Percent of a ‘Successful Fed Communications’ Strategy Comes from Simply Pursuing a Goal-oriented Monetary Policy Strategy – Federal Reserve Bank of Chicago

Banks:

RBS has lost all the £46bn pumped in by the taxpayer – Telegraph

Is Wall Street playing the lottery with its customers’ money? – The Guardian

20 Largest Banks by Market Capitalization – WikiBrains