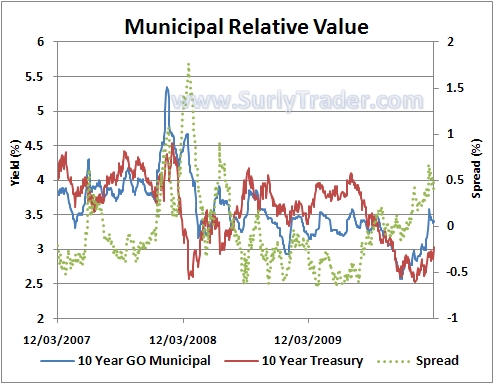

It was very difficult to continuously suggest that interest rates were unattractive even as they grinded lower month after month. From April of this year until mid-October, the ten year treasury rate dropped from its high of about 4% to a sobering low of 2.38%. I consistently suggested that buying a 10 year corporate bond for a measly 3% yield would be a mistake in the long run. On the other side of the fence, a multitude of prognosticators were suggesting that we were just on our own trajectory to a Japanese normal of 1% 10 year rates.

The interesting aspect of interest rates is that they often go up much quicker than they move lower. It took the 10 year treasury yield about 4 months to move from 3.3% to its low, but it has taken only two months to retrace its steps back up to 3.3%, and the majority of that has happened in a few days.

The current dart upwards is related to the extension of tax cuts and especially the unexpected compromise from Obama that is predicted to add $148B to the deficit. This tax cut extension was most likely priced into the market, but the compromise was not. The interesting question is whether the market is interpreting this as a spur to growth (bad for bonds via inflation) or because it is a signal of the United State’s lack of fiscal discipline. The recent economic news, especially the sub-par employment report, certainly does not support our rapidly rising interest rates from a fundamental sense.

Another interesting question to ask – how fast and far would interest rates have to spike in order for politicians to understand the harm that they are causing?