Guest Post: J.W. Jones from Options Trading Signals

At the risk of stating the obvious, the recent market action in the commodities has been manic with wild gyrations of price in a wide variety of basic materials, metals, and energy. Given these wild fluctuations in price, I thought we could look at an options trade in USO that gives a high probability of success.

In order to give a bit of a conceptual framework for this sort of trade, let me share the way I look at these. Development of precision high altitude bombing during World War II resulted in a dramatic reduction in casualties while inflicting devastating consequences to enemy forces. I view the sort of option strategy described below as the equivalent of high altitude precision bombing. We will extract substantial profit without putting ourselves at high risk of damaging anti-aircraft fire.

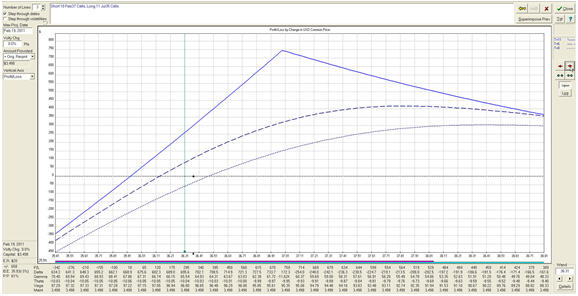

As is shown on the daily price chart below, there is substantial support in the region of 35.60-36 provided by a recent swing low and the 200 period moving average.

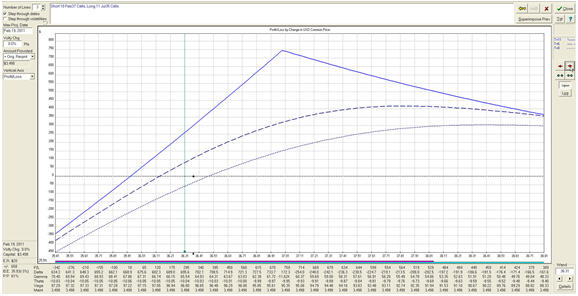

In selecting the structure of option trades, I usually like to consider the volatility environment in which we currently operate. This is important because a very strong tendency of implied volatility is reversion to its mean. The knowledgeable trader factors this into his trades in order to put the wind at his back as much as possible. Trades can be selected and constructed to benefit (positive vega trades) or suffer (negative vega trades) from increases in implied volatility. As you can see in the chart below, implied volatility is currently in the lower quartile of its historic value for this specific underlying:

Given the current low volatility, let us look at a strategy that gives us substantial profit from an altitude of 50,000 feet and the ability to roll the trade forward for additional substantial profit. This trade is structured as a “ratio calendar spread”. Now don’t go getting hung up on the name, it is simply a two legged trade in which we buy a longer dated in-the-money call and sell a smaller number of out-of-the-money calls. The trade is diagrammed below:

For those getting used to these sorts of trades and trying to form an organizational framework, the trade can be thought of as a basic calendar spread where an additional contract of the long options is purchased. The addition of this extra contract removes the upside limit on our profitability which would exist in an ordinary calendar spread. As is often the case in option trading, this trade can also be thought of as a “first cousin” to a covered call structure where the long in-the-money contracts serve as a surrogate for long stock. I find it helpful to think of the various option constructions as individual members of several different families. Each family has a number of “family traits” that help make sense of the large number of potential constructions available to the options trader.

One of the characteristics of this family under discussion is the “Sham Wow” factor- “but wait-there’s more”. The “more” in this trade is the ability to “roll” the short calls forward as they expire or, more prudently, as they reach inconsequential value. For example, this trade would have been initiated by selling the February 37 calls at a value of around 57¢. When these calls reach minimal value, let us say 10¢ for discussion, they could be bought back, and the March calls sold to capture substantial additional premium. This process can continue for April, May, June, and July. These additional sales give the opportunity to reap additional profit for the trade.

The risks in the trade are:

1.USO breaks support and continues to sell off

2. Volatility collapses on the long leg of the trade

I have discussed both of these factors in the price chart and volatility chart above when I was developing the logic of the trade. While no guarantees exist for the behavior of either price or volatility, the current trade represents a reasonable balance between risk and probability in my opinion.

As with all our discussions, these considerations are presented for educational purposes and do not represent a recommendation. This is not a solicitation nor should it be considered financial advice. I am simply trying to demonstrate how to use the knowledge of option behavior to construct trades that benefit from high probability events. Bombs away!