As a continuation of my extended vacation, we have another guest post from J W Jones at OptionsTradingSignals.com

I will be back on Monday.

“You can’t lose what you don’t put in the middle.”

– Mike McDermott, Rounders

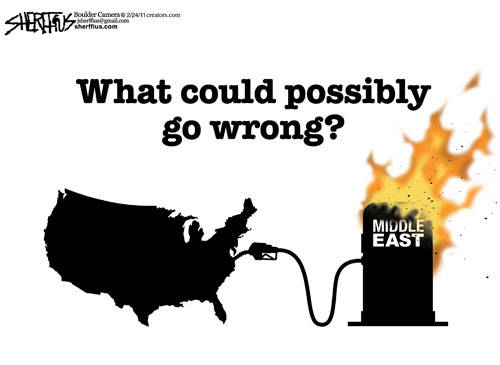

While this week was shortened due to the President’s Day holiday, it has been quite a ride for traders and investors. The 24 hour news cycle certainly intensifies current market conditions as any news focusing on oil or the Middle East protests moves markets. Thursday the International Energy Agency came out and indicated that the expected drawdown in crude oil supplies coming from Libya was being exaggerated. Immediately upon the release of this information light sweet crude oil got hammered and stocks rallied from day lows.

By now most market prognosticators and the punditry will be out declaring that oil prices are going to continue lower and equities are on sale and primed for a snapback rally. I’m not sure that it is that easy. Mr. Market makes a habit of confusing investors with mixed signals. One thing is certainly clear from the recent price action, rising oil prices are not positive for equities here in the United States. What is also clear when looking at the Massachusetts Institute of Technology’s (MIT) version of inflation data (http://bpp.mit.edu) for the United States, it becomes rather obvious that inflation continues to ramp higher in the short term and also on monthly and annual time frames.

If inflation continues to work higher, it would be expected that light sweet crude oil futures prices would work higher as well. The dollar index futures have been selling off while oil and precious metals have rallied until the IEA news came out on Thursday. What should be noted from the recent uncertainty in the marketplace is that the U.S. Dollar Index futures did not rally. This is the “dog that didn’t bark.” During recent periods of market uncertainty such as the European sovereign debt crisis, the U.S. Dollar was considered a safe haven. This most recent market uncertainty caused by political instability in the Middle East has seen the U.S. Dollar Index futures sell off while gold and silver rallied as investors looked to the shiny metals for safety.

So what do all of the mixed signals relating to financial markets really mean? It’s simple, the U.S. economy is not on solid ground, rising oil prices will damage the economy, the world does not necessarily view the U.S. Dollar as a safe haven, and inflation is rising. With all of that being said, what if this is just the beginning of a major rally in energy and the metals? What if prices are going to pull back to key breakout levels, test them successfully, and probe to new highs? As can be seen from the chart above, the U.S. Dollar Index is poised to test recent lows. Should price test the lows and breakdown, oil and the metals could rally in lockstep in a parabolic move.

The daily chart of light sweet crude oil futures illustrates the breakout level that oil prices surged from.

I am expecting a test of that level at some point in the near future. If that level holds, oil prices could be poised to take off to the upside. If prices were to move considerably higher it could place downward pressure on equities and would correspond with the U.S. Dollar cycle lows which are expected by most sophisticated analysts sometime this spring. The intermediate to longer term fundamentals in the oil space are strong and technical analysis could also affirm higher prices very soon. If we see the key breakout level hold and a new rally takes shape on the heels of a lower dollar, the equity market could be vulnerable.

The next few days/weeks are going to prove critical as a lower dollar could change everything. A quick look at the silver futures daily chart illustrates the key breakout level which will likely offer a solid risk / reward type of setup.

As can be seen, silver has had a huge run higher and has broken out to new all-time highs. Gold has moved higher but has yet to breakout and could play catch up while silver consolidates. Longer term I remain bullish on precious metals and oil, but volatility is likely to increase in both asset classes going forward, particularly if inflation continues to increase. Patience and discipline will be critical in order to enter positions where the risk / reward validates an entry.

As for the equity market, it remains to be seen what we will see next week. I am not convinced that the issues in the Middle East are over and that oil is going to come crashing back down to previous price levels. Oil has broken out and if the breakout levels hold I would expect a continuation move higher. If we see price action in oil transpire in that fashion, equities will be for sale and prices could plummet tremendously.

I will be watching to see how much of the recent move lower is retraced. If we see a 50% retracement and prices rollover the S&P 500 will likely be magnetized to the 1275-1285 price range. If that price level is tested and fails, we are likely going to see a 10% correction and potentially more. The daily charts of SPX listed below illustrate the key Fibonacci retracement levels as well as the key longer term price levels that could be tested if prices rollover.

While lower prices are possible, if we see a retracement of the recent move which exceeds the 50% retracement level in short order prices will likely test recent highs and begin working higher yet again. The price action on Friday and next week is going to be critical to evaluate as many traders and market participants are going to be watching the price action closely looking for any clues that might help indicate directionality.

For right now, I am going to be patient and sit in cash and wait for high probability low risk setups to emerge. As I have said many times, sitting on the sidelines can be the best trade of all!

Get My Trade Ideas Here: www.optionstradingsignals.com/profitable-options-solutions.php

JW Jones