MIT had the bright idea of not trusting the government’s CPI numbers, so they came up with their own and called it the “Billion Price Index”. According to their website:

BPP Database Key Facts

- Statistics updated every day

- 5 million individual items

- 70 countries

- Started in October of 2007

- Supermarkets, electronics, apparel, furniture, real estate, and more

Data collection: our data are collected every day from online retailers using a software that scans the underlying code in public webpages and stores the relevant price information in a database. The resulting dataset contains daily prices on the full array of products sold by these retailers. Our data include information on product descriptions, package sizes, brands, special characteristics

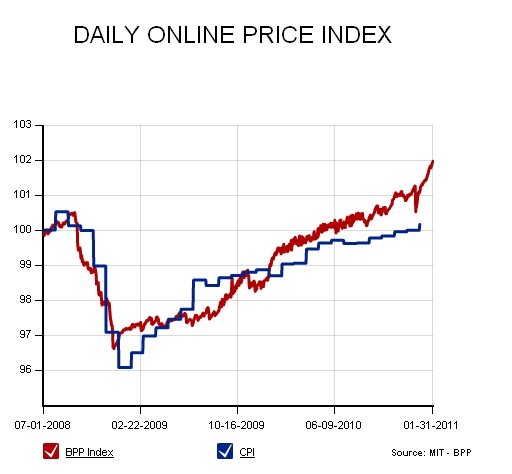

So what does it show? Well, it certainly appears as if inflation is heating up:

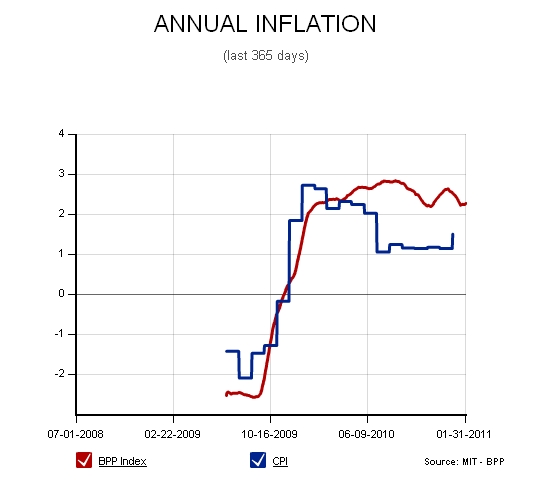

What is probably most important is the annual inflation rate gap between the BPP and the CPI:

The gap between the CPI and what MIT would call true inflation is important because the longer the government can maintain a gap between the two, the further the reduction in real debt. The dollar is depreciated and pension or health care obligations in real terms go down (because most are linked to CPI).

Just how much can they hide and for how long is the question.