One rule that is easy for me to state is that market volatility breeds more market volatility. The question is not whether there is something to worry about, but just how badly you should worry about it. If you look at historical daily stock returns, it is very difficult to find a rule of thumb about “-3% days usually come after +1% for 4 days…” but it is a truth that the past month of market volatility has a predictive power of 65-75% R-squared relative to the next month of market volatility.

After a 30%+ equity return in 2013, everyone should be questioning when the music stops, not if. These same investors should also question just how bad this lack of chairs could get. If you lived through the questioning of 2005/2006, you probably know how much ignorance was embedded in market assumptions. At this point in time you look at the numbers and say that we are too smart (based upon past experience) to let it happen again. The one really dynamic factor that most investors ignore is the marginal dollar of investment that tips the gains/losses in one direction or the other. In the housing bubble in the United States it is (currently) easy to see that easy money going to the housing market bubble was the key factor in the destruction that ensued.

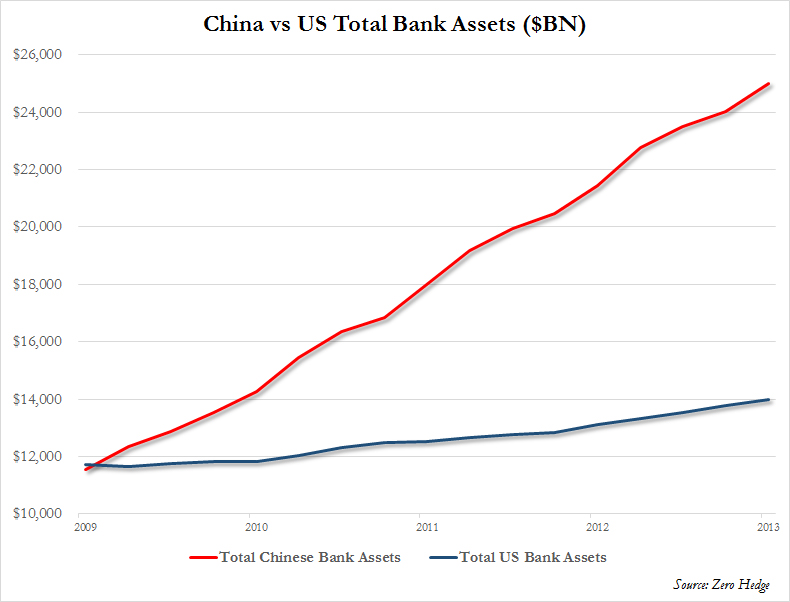

With the slowdown in Chinese (government manufactured) measures of growth, I think it is important to question the dollar amounts in China versus the United States:

None of us will know where the next bubble is directly coming from, but I think it is wise to question every gift before you become complacent.