The United States faces a massive retirement deficit that has not yet been acknowledged by the media, individuals, the government, or even pension funds. According to Ernst & Young, only 4% of middle-income married couples without a pension who are nearing retirement have enough money to last their lifetimes. The overall problem is complex with many different contributing factors, but I will try to summarize the key issues that are causing a crisis in America.

According to the Ernst & Young July 2008 study, those without defined benefit (pension) plans will need to reduce their pre-retirement standard of living by 20-50% in order to bring the probability of outliving their assets down to 5%. Can you cut your income in half comfortably? According to the Organisation for Economic Co-Operation and Development, over 24% of Americans older than 65 live below the poverty line. The United States, Ireland, South Korea and Mexico have the highest old-age poverty rates among the 30 OECD countries.

The most recent snapshot of individual retirement balances is provided by the Employee Benefit Research Institute in an August 2009 study, but only includes data through 2007. Among all families with a defined contribution plan in 2007, the median (mid-point) plan balance was $31,800. According to EBRI estimates, the average defined contribution plan balance dropped to $26,578 from year-end 2007 to mid-June 2009.

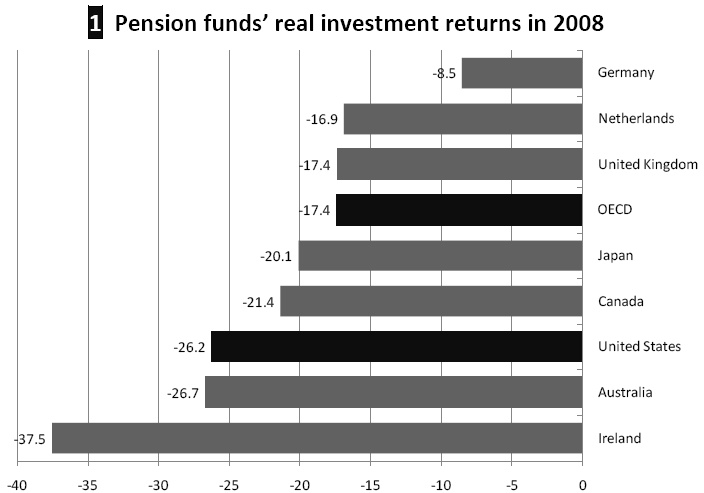

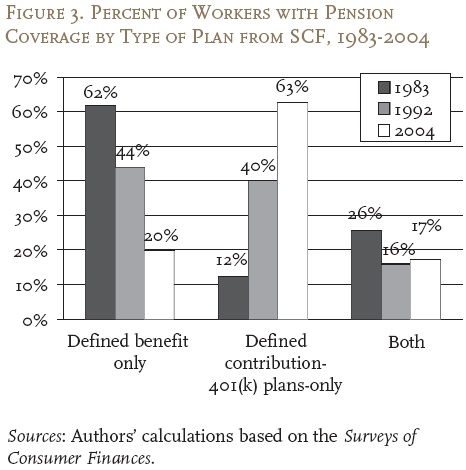

On the other end of the 401(k) self-directed retirement plans are the private, company run defined benefit (pension) plans. As we can see from the Ernst & Young study, it appears that individuals with traditional company run defined benefit (pension) plans are much better off than those without; showing much lower expected probabilities of outliving their assets. The problem lies within the solvency of these pension plans themselves. In 2008, U.S. private pensions had real losses of 26.8% due to their high exposure to the equity markets.

This 26% real hit that U.S. pensions took in 2008, only worsens an already large pension liability deficit in the United States. According to Watson Wyatt and Mercer Consulting, private pension plans started 2009 at 75% funding levels leaving a $400B gap between assets and liabilities. Even if legislation is passed to provide some relief to corporate defined benefit plans, Watson Wyatt still expects them to be 74.5-77.1% underfunded by 2011.

The good news about defined benefit plans is that they outperformed defined contribution plans by 0.8% annually, on average, between 1985 and 2001. If you had only $10,000 in an account and earned 7.8% versus 7%, that would be a $50,000 difference in account value or a 35% difference in ending value over 40 years.

This illustrates the fact that many defined contribution plan participants simply do not have the skills, investment experience, or interest in managing their retirement plan assets. In addition, most plan providers are not equipped to provide the education and training required to assist employees in making the transition to self managed retirement plans. On the flip side, companies have been racing to exit the defined benefit arena and pushing defined contribution plans because it reduces the risk of their own balance sheets.

Who exactly is going to foot the bill for underfunded individuals and companies? Welcome to our bailout nation. I just hope China is willing to fund all of our retirements…