The Asian option payoff depends on the average price of the underlying asset over a specific period of time. The expected payoff of an Asian option is less than the expected payoff of a European option and is therefore much cheaper. On the plus side, the Asian option takes away some of the point of time risks embedded in European options and allow for more stable payoffs.

The payoff of an Asian option simply replaces the expiration price with the average price:

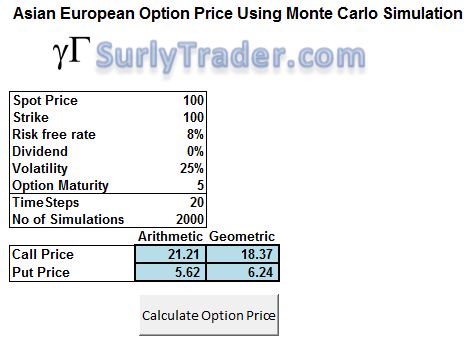

The problem with Asian options (and most exotic options) is that the option price cannot be calculated by simply plugging numbers into the Black-Scholes equation because the payoff depends on the path that the stock price takes until the maturity of the option. The first way to calculate the price is to use a binomial or trinomial tree, but the speed of computers and flexibility of implementation has made monte carlo simulations the more practical method for pricing.

For those of you who are interested in learning how to price an exotic option using Monte Carlo simulations, I have produced an excel spreasheet with modifiable code that is for sale:

Price Arithmetic and Geometric Asian Options with Monte Carlo Simulations through an Excel VBA Macro.