I have spent quite a bit of time looking at volatility in my career. I find volatility to be an extremely great asset class in its own right through options, but when it comes to stock investments it is usually a negative. Volatility represents the variation in the market value of the assets that you hold in your portfolio. The conventional wisdom says that if you hold volatile assets, you will be rewarded. If you hold non-volatile assets, you will be rewarded less. This seems intuitive. If the market value of your portfolio moves around a lot, then you would think you should be rewarded for that risk.

This might be the first post in many looking at this topic because I have learned quite a bit in my own research. What I have found is that volatility can be misleading. I will throw out just one question – is volatility necessarily associated with return?

There are many ways that I could dissect this question, but today I will focus on large cap stocks with data from easily available indices. The S&P 500 constitutes the 500 largest publicly traded US companies. In this mix are tech companies, financials, industrials, REIT’s, utilities and everything in-between. The companies are large in value…that is all they have in common. The less known Aristocrat Index is designed to measure the performance of the S&P 500 index constituents that have followed a policy of consistently increasing dividends for the last 25 consecutive years with equal weighting. We can consider these the “dividend payers”.

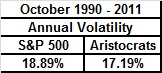

If we look at just the volatility information, it follows a simple theme:

18.9% versus 17.2%…a nearly 1.5% annual decrease in volatility between the two. According to the idea that we should expect to get rewarded for holding volatile assets, we would expect the S&P 500 to outperform. Just exactly how did they do:

18.9% versus 17.2%…a nearly 1.5% annual decrease in volatility between the two. According to the idea that we should expect to get rewarded for holding volatile assets, we would expect the S&P 500 to outperform. Just exactly how did they do:

So wait….over the last 21 years the dividend payers have had less volatility and a significantly higher return? Does this mean that we should throw out the old rules? Are we not paid for holding volatile stocks? We could argue the market cap weighting of the S&P 500 vs the equal cap weighting of the aristocrats, but I think we will find interesting information away from that. More to come.

So wait….over the last 21 years the dividend payers have had less volatility and a significantly higher return? Does this mean that we should throw out the old rules? Are we not paid for holding volatile stocks? We could argue the market cap weighting of the S&P 500 vs the equal cap weighting of the aristocrats, but I think we will find interesting information away from that. More to come.