On a daily basis we all get confronted with a lot of data. In that data resides many false signals and conflicting statistics. Today, I would like to take a step back and look at the housing market as it resides today. The housing market is where most of the trouble started and will most likely be a heavy burden for some time to come.

Housing prices seem to have stablized, but there are a lot of delinquencies that need to be worked through

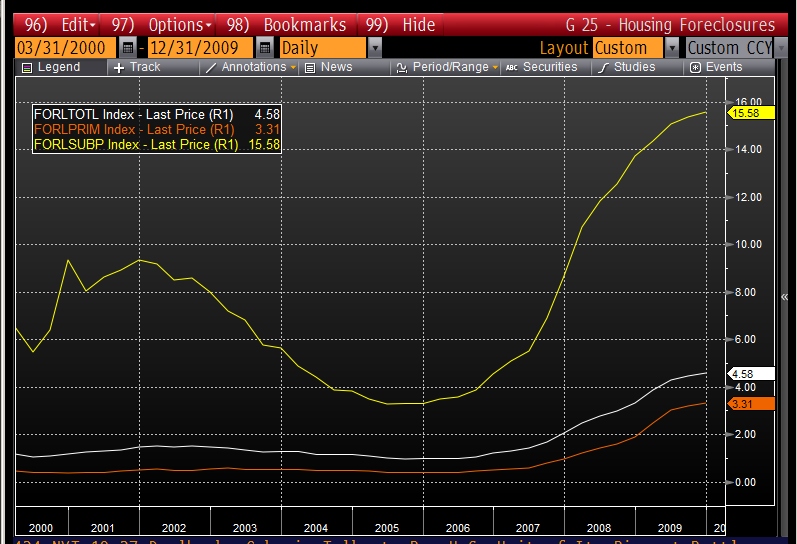

Housing Foreclosures still need to be worked through the system - Have the banks really realized the losses?

Do not expect new housing to provide the jumpstart in the economy. I would not want to be a homebuilder.

Homeowners Versus Home Renters since 1965. Should all of those families really have owned a home? Are we going to realize the long-term average?

This might seem like a depressing bit of statistics, but it is always better to be realistic rather than put your head in the sand. The government will do everything in its power to support the housing market and stem any further declines. The banks are still holding a ton of this risk on their balance sheets and have not realized all of the losses that the collapsed housing market has created. The mortgage modification program was mildly successful and I believe that the next step will be for the government to reduce principal on outstanding mortgages of troubled borrowers. The banks and the government will do anything to keep troubled borrowers in their homes, taking care of the property, and keeping the potentially foreclosed house out of the current housing supply. Just how much has the government supported the mortgage market so far? Just take a look at their trillion dollars of mortgages that they have already bought in a year’s time:

The fed has supported the market in 2009 and the recent Fannie/Freddie buyout programs will support the market for the next 3 months

So if you want to buy a house, by all means go ahead as prices are much more attractive than they have been for a long time. If you are buying a house for a quick rebound in prices, I think you are looking in the wrong place.