Markets can change on a dime. Since the lows were marked in March, the last 9 months have been filled with a reflation of the risk-taking trade. Take money out of less risky assets (treasuries, the dollar) and put that money to work in riskier assets (equities, high yield bonds, emerging market currencies, etc.).

Then comes the game changing news items:

- Default of Dubai

- Better Employment conditions in the US (prospect of rate hikes in the nearer future)

- Downgrade of Greece

- German Industrial output -1.8% versus consensus +1%

- Japanese GDP +1.3% versus consensus +2.8%

What does this all mean? That investors are getting skittish again and a risk reversal has gained strength.

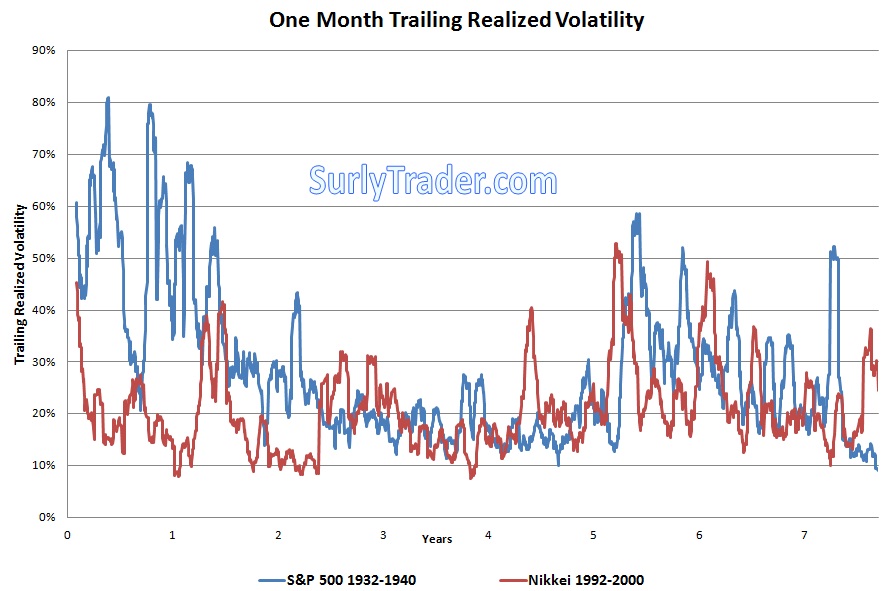

What is to be learned from this? That markets are fickle and in this environment that is particularly justified. The world economies are in highly unstable economic positions with massive government stimulus sloshing around. I was asked by someone in the middle of the year what I expected in the years going forward and I replied, “a lot of volatility”. It is naive for anyone to think that he/she can invest in these unstable markets and remain “right” for extended periods of time. For that reason, I do believe that we are in a “trader’s market”.

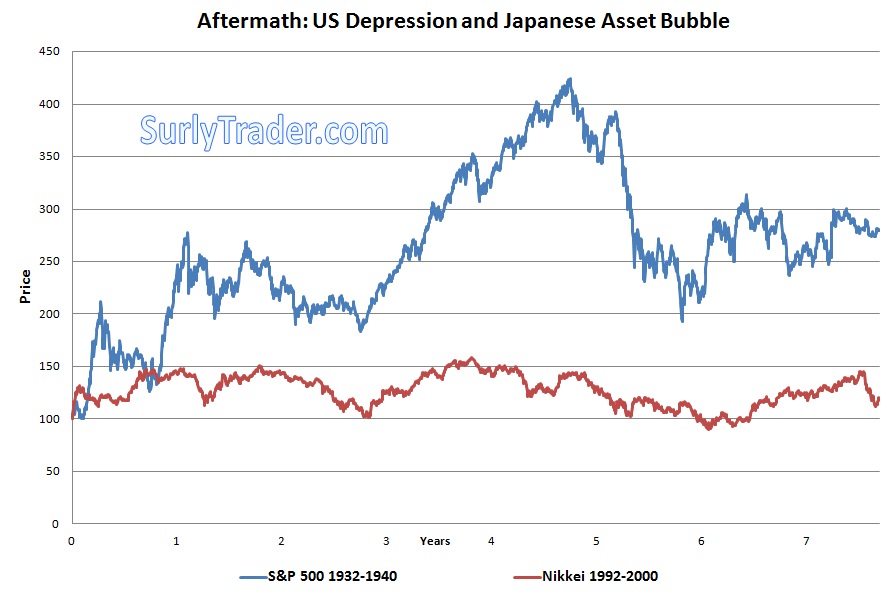

The current economic conditions can only be compared to the great depression and the Japanese asset bubble, but even these comparisons are a far stretch. The only parallel that I can draw is with the relative size of the market dislocations. At no point in the US history besides the great depression did credit spreads gap out as wide and as quickly. At no period in US history besides the great depression did we experience the annualized volatility of 2008. Mix that idea in with the financial de-leveraging that Japan experienced to what we *need* to experience and I think we can at least make a case that our economic environment is in the that time zone as the other two massive historical dislocations.

For the sake of argument, let us assume that March was indeed our market low and the darkest part of this economic abyss, then what does that mean going forward?

The equity market volatility was over 30% for nearly 8 years after the bottom was reached during the great depression. After the bottom was reached in Japan’s asset bubble, equity volatility was nearly 23% for 8 years.

Intuitively this makes sense to me. After huge market and economic dislocations, it takes years and possibly over a decade to find stabilization. Throw in a developed country default or a period of hyperinflation and even the smartest economist’s glasses become fogged over. We should all begin expecting the unexpected as we go forward, because no one can predict how this game is going to play out.