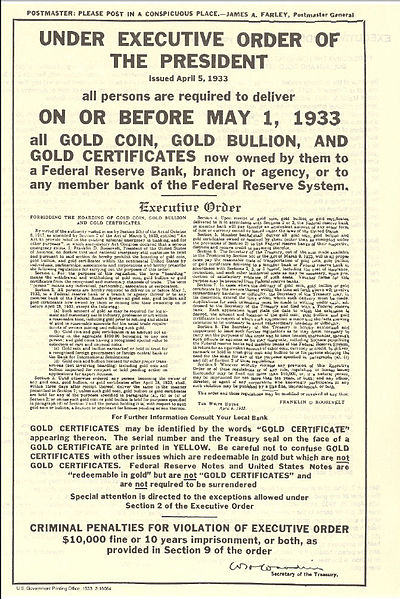

The fear of government seizure of private assets is one of the reasons many gold bugs suggest that the only true way to invest in gold is to buy physical gold that is held in countries with fiscally sound and politically stable governments. We have not seen much seizure of private assets in the United States except for the sporadic “eminent domain” issues in which the Government usually claims land for civic or public use. Franklin Roosevelt’s executive order 6102 is far from memory:

“Executive Order 6102 required U.S. citizens to deliver on or before May 1, 1933 all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve, in exchange for $20.67 per troy ounce. Under the Trading With the Enemy Act of October 6, 1917, as amended on March 9, 1933, violation of the order was punishable by fine up to $10,000 ($167,700 if adjusted for inflation as of 2010) or up to ten years in prison, or both.”

It just so happens that a similar tactic is currently being used by some European countries. In Hungary, the government told their citizens that they could either remit their individual retirement savings to the state, or lose the right to the basic state pension (but still have an obligation to pay contributions for it). This extortion would give the government $14B in private retirement assets.

In Bulgaria, $300M of private retirement savings was to be transferred to the public pension. The government gave way after strong protesting by trade unions.

In Poland, the government wants to transfer 1/3 of future private retirement contributions directly to the public social security system. Since there are no actual assets in the public social security system (just as in the United States) the funds would go directly to the government’s budget.

In 2001, Ireland established the National Pension Reserve Fund to support Irish pensions in the years 2025-2050. In 2009, the government earmarked €4B from this fund to bail out Irish banks. In November 2010, the remaining €2.5B was seized to bail out the rest of the country.

In November, France set aside €33B from the pension reserve fund to reduce the short-term pension deficit. They moved assets that backed pension payments for years 2020-2040 so that they will be used in years 2011-2024. Steal from the future to pay the present.